The Genesis

Streitwise’s sponsor, Tryperion Partners, has invested in commercial real estate for years through exclusive closed-end partnerships on behalf of high-net-worth and foundation clients. We’ve invested in all major property types across the U.S. (including office, industrial, retail, multifamily and hotel) and were able to add significant value. These “value add” deals presented an attractive risk-adjusted opportunity to achieve 15+% returns – and our investors agreed. So much so that they invested over $100 million into our partnerships, which we’ve turned into a real estate investment portfolio totaling more than $275 million.

But different investors have different risk tolerances. Some are more risk-averse or are financially less able to absorb investment losses, and they should reduce their risk exposure by targeting more moderate returns. Focusing on these investors, we’ve created Streitwise, a non-traded REIT that provides easy access to a diversified portfolio of institutional-quality real estate to everyday investors with a 8-9% annual return target.1

What is a REIT (Real Estate Investment Trust)?

Simply put, a REIT is a tax-advantaged company that owns income-producing properties and distributes the cash flow to investors in the form of dividends. There are two primary types of REITs: Traded REITs and Non-Traded REITs.

Traded REITs are listed on a major stock exchange (i.e. the NYSE or Nasdaq), thus offering built-in liquidity. But in return for liquidity, Traded REIT shares are typically more expensive and offer a lower dividend yield.

Non-Traded REITs are not listed on a major exchange; instead, they are mostly sold through financial advisors. Non-Traded REITs generally promise a higher dividend yield than Traded REITs offer, but are less liquid.

It makes sense that investors who are less concerned about liquidity would prefer a Non-Traded REIT over a Traded REIT. And as mentioned, Non-Traded REIT shares are sold through financial advisers… But are they working for the investors’ benefit, or their own?

Financial Advisors: The Gate Keepers

Financial advisors provide wealth management services to a wide range of individuals, and work collaboratively to optimize their client’s investment portfolio. Importantly, financial advisor compensation may vary greatly depending on the investments chosen. For example, Non-Traded REIT shares often result in a 7% commission to the financial advisor. 7% Commission! And that commission is deducted dollar-for-dollar from the client’s initial investment. If that sounds unfair, prepare for it to get worse.

Financial Advisors and Non-Traded REITs: The Unholy Alliance

Financial Advisors and Non-Traded REITs: The Unholy Alliance

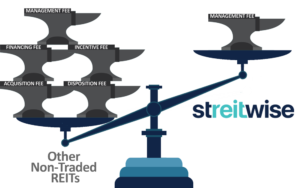

A key question to ask yourself is: Why do financial advisors charge such high commissions for selling Non-Traded REIT shares? The reason: financial advisors require ample enticement to recommend an investment product that itself charges excessive fees. The upfront costs of Non-Traded REIT shares are typically 10-15% of the initial investment.‡ Then there are ongoing costs, such as asset management fees, acquisition fees, disposition fees, financing fees and incentive fees, all of which impact total returns negatively – sometimes severely so. It’s fair to say this model is rife with conflicts of interest between financial advisers, Non-Traded REIT sponsors, and investors.

Enter Streitwise…

Streitwise was designed to combine the benefits – while avoiding the shortcomings – of both Traded and Non-Traded REITs. By structuring Streitwise as a Non-Traded REIT that avoids financial advisors and sells shares directly to investors on our website, we provide direct access to a diversified portfolio of institutional-quality real estate with an ultra-low cost structure. No middlemen. No hidden or excessive fees.

Streitwise vs. The Competition

Let’s suppose Company X is a Non-Traded REIT with 12.5% upfront costs. Assuming the same 3% annual appreciation and 7% annual cash yield over a 5-year investment period, Streitwise earns 42% more profit than Company X does based on upfront costs alone.

Numbers don’t lie, and the difference is clear. Streitwise is the smart way to invest in real estate.

*The figures shown in the table above with respect to Streitwise are not actual returns and are for illustrative purposes only. It is not a representation, warranty, or guarantee of future investment performance. Investors should not assume that we will achieve these returns for our investors or that we will perform comparably to our competitors.

Footnotes

‡SEC’s Office of Investor Education and Advocacy, Investor Bulletin: Non-traded REITs, August 31, 2015.

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.