Streitwise is sponsored and managed by Tryperion Holdings. Tryperion executes value-add strategies through direct and joint venture investments in inefficiently-priced U.S. markets. Tryperion utilizes its extensive real estate expertise and industry relationships to create value through aggressive management and leasing, strategic capital improvements, and prudent financing programs.

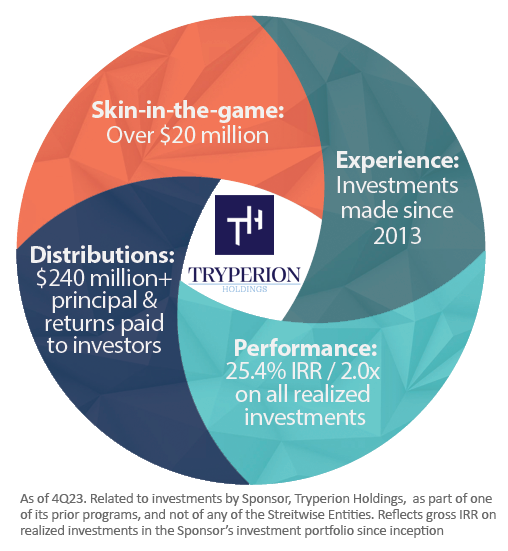

Tryperion has acquired and managed over $750 million in commercial real estate properties, over $5.4 billion of transaction experience, and over $190 million in distributions to date. Using proven investment strategies, Tryperion has generated an annualized 25.4% IRR / 2.0x on all realized investments3.