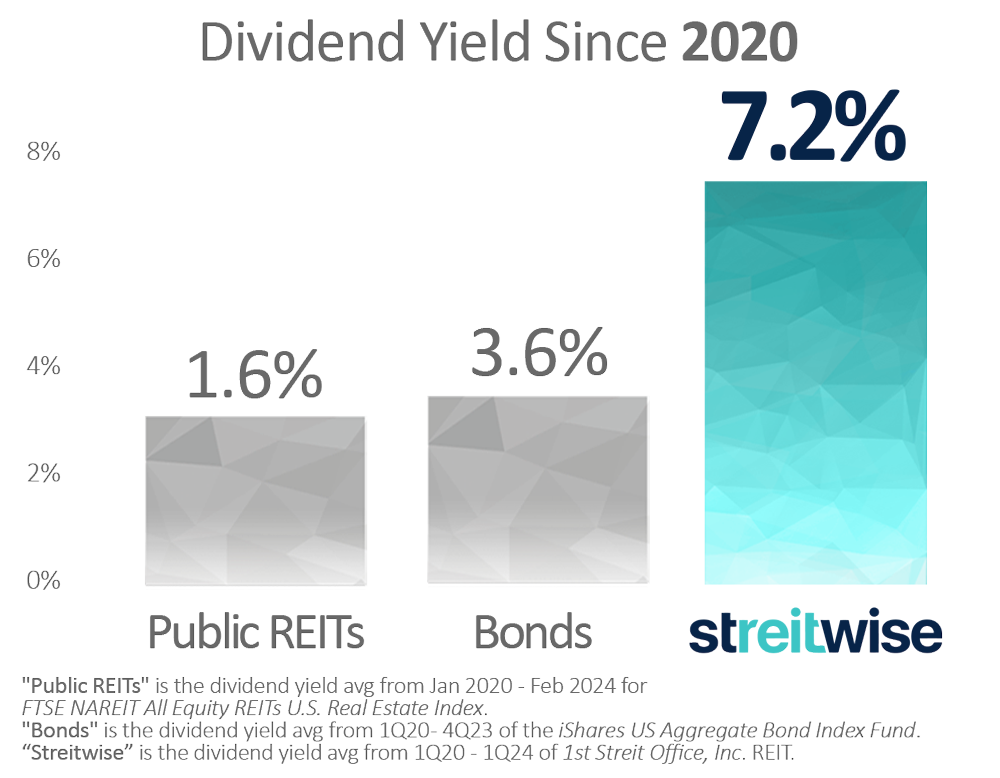

Streitwise has generated strong passive income cash flow for investors since inception in 2017. From 2017 to 2024, Streitwise has generated a dividend return through 30 quarters, with an average dividend yield of 8.3%1.

All dividends quoted are net of fees, with fees already taken out.