Many investors ask if REITs are taxed differently than other asset classes and the answer is a resounding “yes”. A REIT in a taxable account has numerous useful tax benefits that simply aren’t available to many other asset classes when you pay taxes. Here’s a look at just a few:

The Pass-Through Deduction

Thanks to the 2017 Tax Cuts and Jobs Act, sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors: the pass-through deduction.

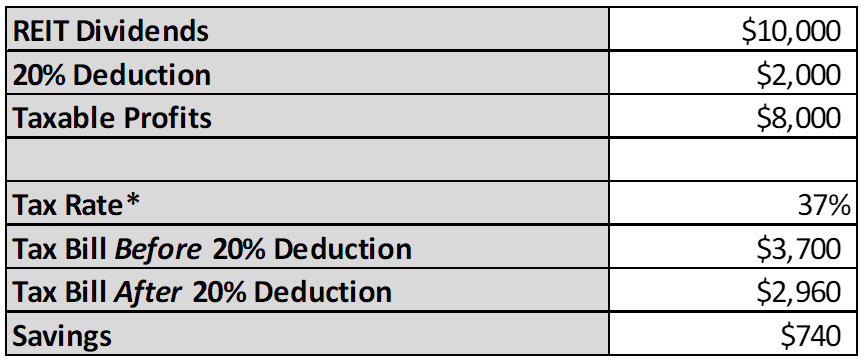

The pass-through deduction allows REIT investors to deduct up to 20% of their dividends. Investors in the top tax bracket can potentially see their tax bill for dividends go from 37% to 29.6%. That means that you’re saving up to $740 annually on $10,000 of REIT dividends. Here’s the simple math:

Avoiding Double Taxation: No Corporate Income Tax

REITs, like many companies, distribute earnings to investors in the form of dividends. Unlike many companies however, REIT incomes are not taxed at the corporate level. That means REITs avoid the dreaded “double-taxation” of corporate tax and personal income tax. Instead, REITs are sheltered from corporate taxes so their investors are only taxed once. This is a major reason income investors value REITs over many other dividend-paying companies.

Since REITs distribute most of their income, the income is only taxed at the individual shareholder level. This can be beneficial for investors in lower tax brackets or for those managing their taxable income through retirement or other tax-deferred accounts.

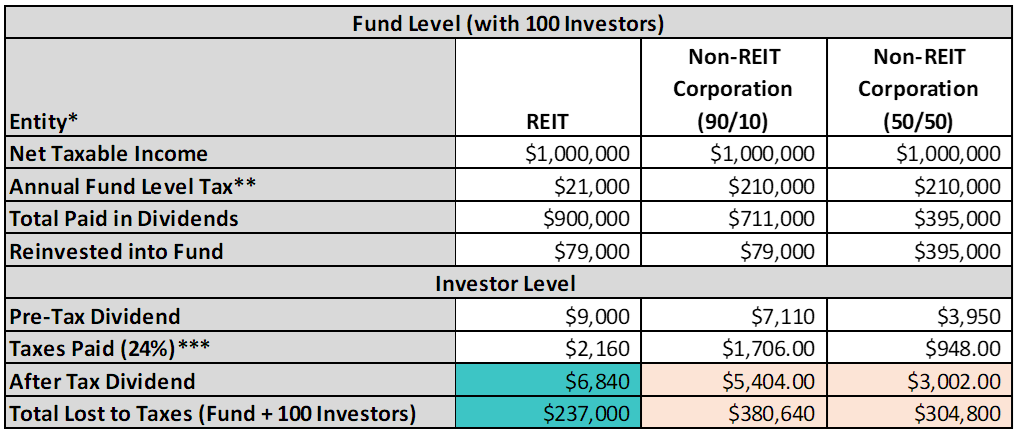

For example: Compare a REIT, a non-REIT corporation that distributes 90% of income to investors in the form of dividends and 10% reinvested, and a non-REIT corporation that distributes 50% of income to investors and 50% reinvested. Assume the Net Taxable Income is $1 million for all three at a 21% federal corporate tax rate.

How do REITs pay dividends? REITs are required to distribute at least 90% of income to investors through dividends and any portion of income distributed to investors is not taxable at the fund level, meaning just $21,000 is paid in federal corporate taxes compared. The dividend income non-REIT corporations pay is subject to corporate income taxes, which means less funds available to distribute to investors.

Depreciation

Another gift the tax code has bestowed upon real estate investors is the concept of depreciation. As it relates to REITs, depreciation basically serves as a tax deferral mechanism. The greater the amount of depreciation expense, the more likely it is that the taxable portion of the REIT dividends will decrease.

Depreciation works to effectively reclassify certain dividends from “ordinary income” to “return of capital.” Minimizing “ordinary income” dividends means minimizing the amount of dividend income that is taxed at the personal rate, while maximizing the amount of income that is taxed at a 25% rate.

The 90% Rule

Historically, REITs have been given special tax treatment as a carrot to everyday investors seeking access to a diversified portfolio of real estate without the large capital investment required to actually acquire such a portfolio. In return, the tax code holds REITs to certain standards. One such standard is the 90% rule, which requires REITs to pay out at least 90% of its earnings as dividends.

The 90% rule was created to encourage REITs to fulfill the original goal of allowing everyday investors to enjoy passive income from a diversified portfolio of real estate. The 90% rule is a check on executive management which may seek to reinvest earnings rather than distributing them directly to shareholders.

Consult a Tax Advisor

The U.S. government has used the tax code to encourage investors to participate in real estate gains since the creation of real estate investment trusts in 1960. As was the case in the 2017 Tax Cuts and Jobs Act, more tax benefits continue to emerge for REIT investors with each new draft of the tax code. So the next time you’re with your tax advisor, ask how investing in a REIT can get you the income you want and the tax breaks you deserve using examples of REIT like Streitwise. You may even see more tax benefits with REITs than general real estate holding company tax benefits.

Streitwise Taxes

Unless your investment is held in a qualified tax-exempt account, your dividends will generally have REIT tax implications. Dividends will typically come in three forms – (i) return of capital dividends (which are generally not taxed and instead reduce your tax basis for future capital gain consideration), (ii) capital gain dividends (which are generally taxable at long-term capital gain rates), or (iii) dividends from current or accumulated earnings or profits (which are generally taxed at ordinary income rates). However, because each investor’s tax considerations are different, we recommend that you consult with your tax advisor.

What type of tax returns will I get – 1099 or K1?

Investors will receive a Form 1099-DIV, if required, by January 31 of the year following each taxable year if they received qualified REIT dividends.

Are taxes calculated as capital gains or taxable REIT dividend income?

Regular income, although you benefit from the tax advantages of REITs as explained above.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.