Streitwise has declared a $0.21/share dividend for 3Q20, which equates to 8.4% annualized based on the original $10.00/share offering price, or 8.3% based on the updated NAV of $10.07/share. Dividends will be distributed on October 9th pursuant to the payment option selected in the Investor Center.

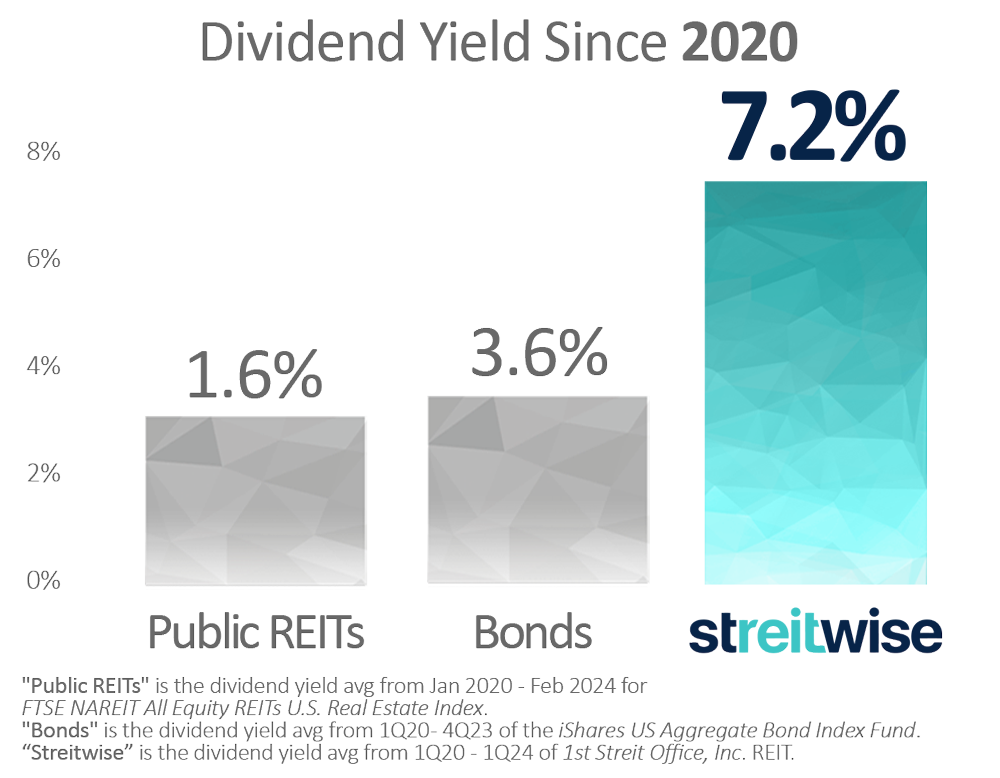

We have been consistent since announcing in 2019 that our dividend yield going forward would likely be 8-9% as we amortize debt and continue to re-invest in our properties. Despite the significant volatility in the public markets and the pandemic’s severe impact on the real economy, we believe we are still on track to achieve our original 8-9% dividend guidance for 2020.

The investment sales market, particularly for office properties, remains largely quiet as sellers are not yet willing or forced to part with assets at current clearing prices. We believe patience will be rewarded as we consider new acquisition opportunities.

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.