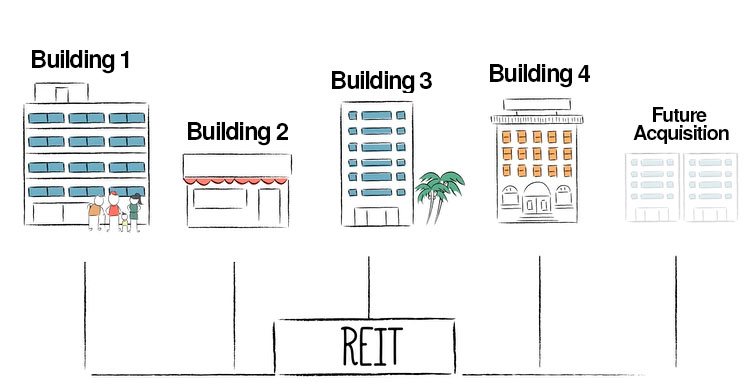

One of the most effective ways to build wealth is through real estate investing. Roughly 90% of the world’s millionaires have real estate somewhere in their investment portfolios. There’s a misconception around real estate investing that says that you need to be wealthy before you can even dip your toes in real estate. While that may have been true in the past, this is simply not the case today. Thanks to the creation of investment vehicles such as real estate investment trusts, also referred to as REITs. With REITs, everyday investors get the opportunity to own shares of a real estate portfolio and be directly invested in real estate as an asset without needing to directly facilitating a real estate transaction, such as a traditional mortgage for a home one would buy. Now anyone can take part in high-dollar investments with a variety of different options that may be available.

Different Types of REITs

Different Types of REITs

There are different types of REITs to consider.

Publicly Traded REITs

This type of REIT is listed on a publicly-traded security exchange, such as the NYSE, and shares are bought and sold by individual investors. Advantages are that any investor can purchase a publicly-traded REIT just like a stock. Disadvantage is that a publicly-traded REIT may rise and fall with the stock market. Some of the inherent advantages of diversification disappear with public-traded REITs.

Public Non-Traded REITs

While they’re registered with the SEC just like publicly-traded REITs, public non-traded REITs are not traded on the stock exchange. Many investors are drawn to this option, since these REITs are not impacted by market fluctuations and the returns are potentially higher than publicly-traded REITs. However, it’s important to note that since these REITs are less susceptible to market volatility, they do provide lower liquidity potential. The trade-off is a liquidity premium where dividend returns may be higher than what you see on the public stock exchange. Non-traded REITs are particularly noteworthy in the past for lack of accessibility to everyday investors and when they are available, having very high fees that cut into returns. Transparency can also be a concern for some non-traded REITs and investors will have to do a lot of research about what real estate assets they are purchasing in the REIT.

Streitwise is a non-traded REIT that is uniquely available to investors of all income levels, is openly transparent about its portfolio, and has a low fee structure.

Private REITs

Much like the name suggests, private REITs, also referred to as private placement REITs, are only available to an exclusive group of investors. These types of REITs are not liquid, and are not registered with the SEC.

Different Asset Classes

In addition to different types of REITs, there are also different ways that REITs invest in pieces of real estate.

Equity REITs

This is the most common type of REIT. Under this concept, the profits generated by the trust are not obtained through the liquidation of the property (or properties) that have been invested in. Instead, the trust and its investors receive profits based on the rent paid by the tenants of the property. Streitwise is an equity REIT.

Mortgage REITs

Also referred to as REITs, mortgage REITs provide money to real estate operators through direct lending or the purchase of mortgage-backed securities. It’s important to note that this type of REIT is heavily impacted by external forces such as interest rates and other market conditions, making them a riskier option for investors.

Hybrid REITs

Just like the name suggests, this type of REIT provides a mixture of equity and mortgage REITs. These diverse portfolios occasionally cost more to invest in, but their increased diversity makes them appealing to potential investors.

Different Industries

REITs can vary by industries and have specialties where investors may feel more comfortable investing in a specific sector of the real estate industry.

Retail REITs

Portfolios of real estate that can be in shopping malls, retail centers, restaurants, and single-standing stores. Most shopping centers you encounter are owned by a REIT.

Residential REITs

This can be single-family home portfolios, residential buildings such as multifamily and condominiums, and other manufactured homes.

Commercial / Office REITs

This is made up of a portfolio of office and/or commercial buildings. While office itself has struggled as a result of the rise in WFH and the pandemic, the portfolio can vary extensively based on areas of the country and some regions and types (such as Class A office) may far outperform the market as a whole.

Other Types

There are a variety of other types as well including healthcare REITs, industrial REITs, life science REITs, and more.

Pros and Cons of REITs

As is the case with any type of investment, there are pros and cons that you will need to consider. Depending on your own goals and investment strategy, these pros and cons can either be deal-makers or deal breakers for you.

Pros:

- You don’t need to do the work: If you purchase a piece of property on your own, you become solely responsible for the improvements, management, and every other facet of owning it. You are also responsible for all of the taxes associated with owning the property and the profits it generates. When you invest in a REIT, the company that you’ve invested in handles all of those aspects for you.

- Professional managed: Speaking of the company that you’re investing in; they are generally staffed by industry professionals who bring knowledge and expertise to the table. When they choose a property, you know that they have done their due diligence and have a business plan in place that will put them in the best position to be profitable.

- Tax benefits: REITs have special tax benefits including the 20% pass-through deduction, and benefits of depreciation.

- Passive income: The SEC has guidelines for all REITs that at least 90% of taxable income must go back to shareholders annually in the form of dividends. These dividends can be valuable cash flow for investors.

- Accessible for more investors: Investing in a REIT allows you to invest in real estate without having access to an abundance of cash. Instead, you can use the cash that you have available to you to make an investment. You won’t be responsible for the full price of the property, or the hefty bills associated with rehabbing or managing the space. Instead, your limited amount of money can be used to earn you a right to a portion of the profits that the property generates.

Cons:

- Volatility: Market fluctuations can make REITs incredibly risky for investors, just like they do with any sort of publicly traded investment. Obviously, the real estate market is an ever-changing market, which means that your investment will come with an inherent amount of risk.

- Liquidity: Additionally, REIT investments are generally more long-term than those investments that provide quick liquidity. While you may be able to sell your shares at certain times, in order to maximize your personal profits, you’ll need to be willing to leave your money in the REIT for an extended period of time.

- Lack of control: Any investors are hesitant to invest in REITs because of the lack of personal control. If you’re a stock market investor, this idea isn’t that foreign to you, but some real estate investors like to have more control over their funds.

A Streitwise, we understand that REITs are a valuable tool for real estate investors of all experience levels. Our team of industry professionals would love to work with you to help you achieve all of your investment goals.

Adam Luehrs is a writer during the day and a voracious reader at night. He focuses mostly on finance writing and has a passion for real estate, credit card deals, and investing.

Different Types of REITs

Different Types of REITs