At the end of every financial quarter, investors wait for their dividend checks. Whether you’re a large accredited investor who has an established, diverse portfolio or you’re just getting on your feet as a beginner investor, receiving dividends in the form of passive income can be an exciting prospect. While it’s incredibly tempting to use those dividends to splurge on trips, a new gadget or other discretionary expenditures, it’s a good idea to consider how reinvesting your dividends can supercharge your future returns and help your financial future.

How Dividend Reinvestment Programs (DRIPs) Work

Dividend reinvestment programs are designed to let investors obtain additional stock in a company you already own shares in without having to work with a broker. Instead, investors who utilize a dividend reinvestment program simply use their dividends to purchase more stock in the same company, allowing them to obtain more shares in the company at an expedited pace.

Instead of cashing out dividends and using them to purchase more funds, a dividend reinvestment program allows you to automatically roll your dividends back into the program, amassing more shares with less work from your end.

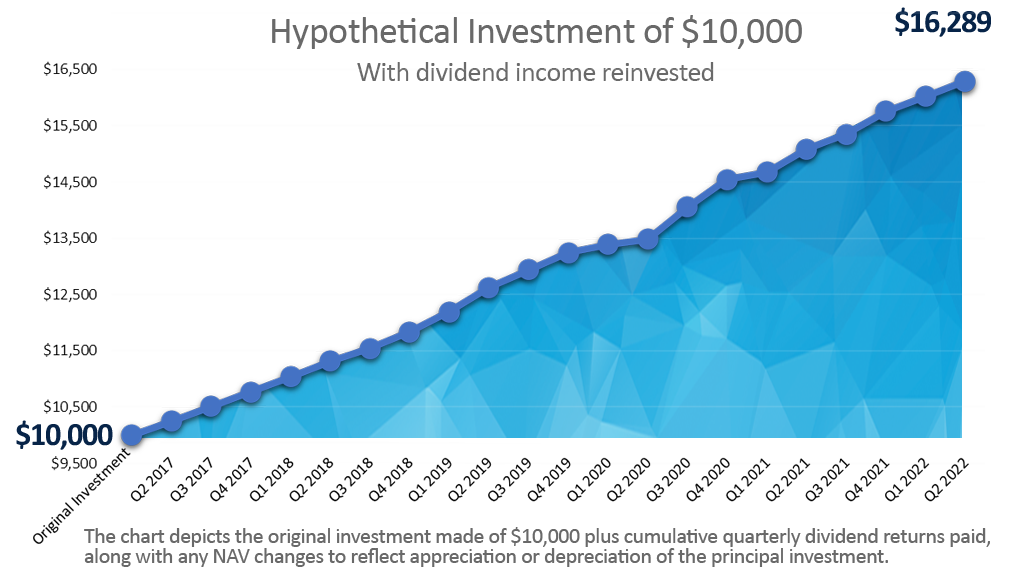

When liquidating funds, shares reinvested are on the same schedule as the principal amount the dividend was paid out of. For example: Say you invested $10,000 in 2017 and that grew through dividend reinvestment to be over $15,000 in 2021. The liquidation amount will be based off of the principal when first invested, per the redemption schedule: https://streitwise.com/redeem-funds

Choosing a dividend reinvestment program provides plenty of benefits. Streitwise’s Dividend Reinvestment Plan (also referred to as a DRIP) is available to all investors once their investment is finalized. Understanding the benefits of the Streitwise DRIP can help you make educated decisions about what to do with your dividends.

Dividend Reinvestment Programs are Flexible

As an investor, you know that having an increased amount of control over your investments is one of the most important things. Since every investor has his or her own investment strategy in mind, increasing the amount of control that you have over your own funds is incredibly important. Different sponsors have varying policies in place, allowing you to contribute as little as $10 or as much as $500,000.

At Streitwise, we take your full disbursement amount and purchase as many shares as possible. This could be a $25 dividend check or a $10,000 dividend check. This circumvents the normal $500 reinvestment minimum that applies to adding additional funds and gives you another way to quickly generate more equity in the REIT.

Benefit from Compound Interest

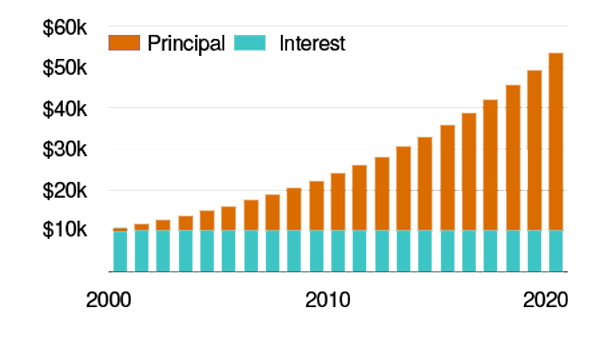

Hold cash flowing real estate long enough, and dividends reinvested can compound to produce handsome gains. To illustrate this point:

- Year 2000: You invest $10,000 in a REIT with dividend reinvestment done quarterly.

- Year 2020:

- At 6% annualized return: Your investment would be worth $34,925. A 249% total return.

- At 8% annualized return: Your investment would be worth $52,773, a 428% total return.

- Note: This assumes zero growth in the REIT stock price and just reinvesting the dividend yield.

Our goal is to help our clients make the most out of their investments. Every program that we offer, including the Streitwise Dividend Reinvestment Plan, is designed to make sure that you are getting a positive return on your investment. DRIPs are especially effective for investors who are willing to treat their investments as a long-term proposition. As long as you don’t need to pull your dividends out every quarter, you can change the way that you approach those funds. When you have found a good stock that is providing quarterly dividends, using those dividends to obtain more shares is a great way to continue to increase your own net worth.

Adam Luehrs is a writer during the day and a voracious reader at night. He focuses mostly on finance writing and has a passion for real estate, credit card deals, and investing.