Looking past short-term volatility is easier said than done, especially when public stock market fluctuations are significant enough to reach the daily news flow.

Abnormal swings are largely random, subjective and based on mood swings or external shocks. With the bulk of one’s portfolio tied up in publicly-traded assets, it becomes easier to be susceptible to the psychological pressures of having to “do something.”

While all investments come with their unique risks, experienced investors understand the importance of minimizing the risks within their control, quantifying the risks outside their control, and maximizing returns appropriately. Investing in commercial real estate provides diversification to help build net-worth and create a secure financial future.

How community plays into short-term volatility

In recent weeks, the impact that shared-interest communities have on the stock market is impossible to ignore. You’ve probably heard about the news surrounding certain publicly traded stocks such as video game retailer Gamestop, movie theater chain AMC, and mobile phone company Blackberry. Thanks to communities such as WallStreetBets focusing on these stocks, the market cap for these companies saw double and tripling of values overnight.

While that certainly sounds like a great thing, their values plummeted just as fast. In order to supposedly protect investors against this volatility, brokers such as Robinhood put a pause on trading stocks associated with those companies.

That pause did nothing to protect investors who had already invested, and likely influenced the preceding share price falls. Those investors fell prey to this “short-squeeze.” With so much potential for similar instances to take place in the future, the need for a way to hedge your risk when investing is crucial.

Alternative options

Successful investors all have one common characteristic: diversified portfolios. When the bulk of your portfolio is tied up in publicly-traded stocks, you are at the mercy of an economic ecosystem in which you may have little familiarity or control.

With limited ability to impact the success of these investments, it’s a great idea to add alternative investment options to the overall portfolio. Commercial real estate provides one such option for those looking to mitigate risk and diversify their investment portfolios.

When many people think of real estate investing, their mind goes straight to the “fix-and-flip” model, popular on television, or single-family homes. However, commercial real estate can often be considered a safer option on the risk profile scale and more accessible for everyday investors priced out of their markets.

Commercial real estate includes multifamily, shopping centers, office complexes and other properties that are used for business purposes. Investors in commercial real estate can potentially receive passive income while investing their money in an asset class that isn’t as volatile as the stock market.

How do I invest in commercial real estate?

The historic inaccessibility of sub-institutional commercial real estate for regular investors is well documented. Most private commercial real estate investing requires being a high net worth investor. Streitwise is different and offers an opportunity open to all investors that allows you to invest in a portfolio of sub-institutional commercial real estate.

Thanks to the JOBS Act, signed into law in 2012, investing in commercial real estate deals as a “crowd” is now possible. Some companies have now offered crowdfunded REIT models that enable investors to invest in a variety of real estate asset types while others have created offerings for one-off real estate fundraising projects. These REIT models and one-off projects can vary in type (such as equity or debt), risk profile (such as core-plus or opportunistic), fee types (low cost upfront models or higher waterfall fees), asset type (such as multifamily or office or farmland).

Many of these offerings are strictly only for accredited investors while some offer the ability for non-accredited investors to invest, as well. Streitwise is one of those rare offerings open to all investors that allow you to invest in a portfolio of commercial real estate deals in a REIT.

How does commercial real estate compare to the stock market?

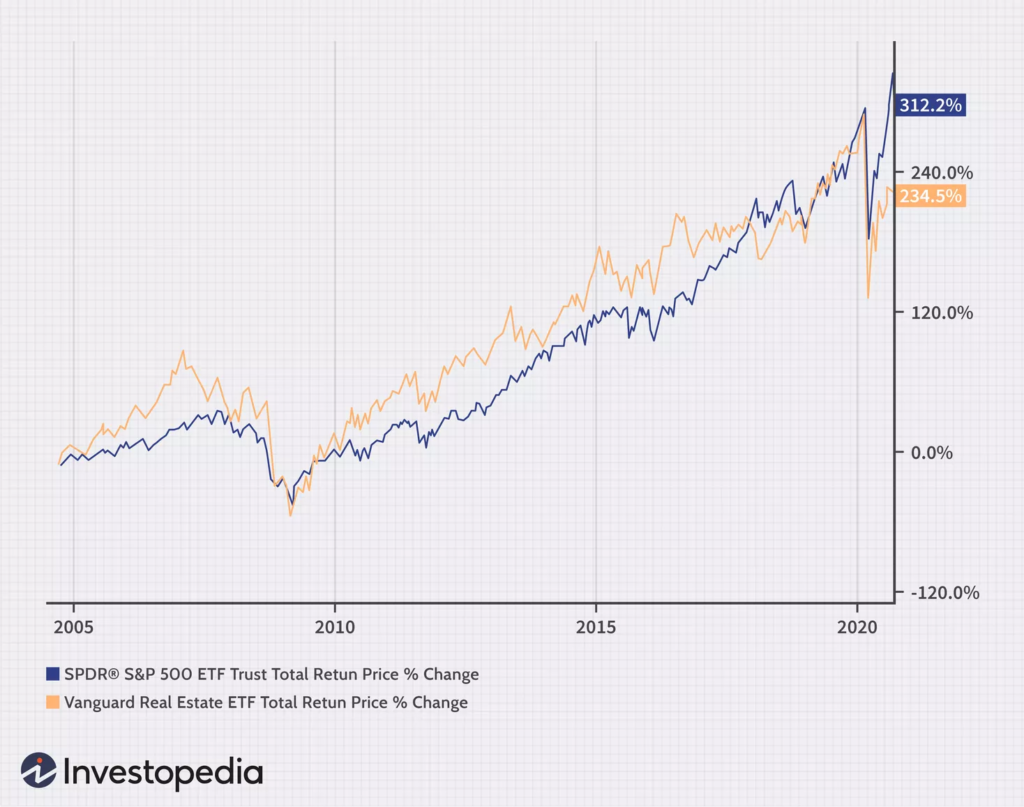

Comparing commercial real estate investing with traditional stock market investing is difficult because the assets themselves are so different. The factors that impact the prices of commercial real estate compared to the factors that alter the prices of stocks are completely different mechanisms and create a true “apples to oranges” scenario. However, we can still get a general idea of the returns generated by these two investment options by looking at the total returns they generated.

This data provided by the S&P 500 ETF (SPY) and the the Vanguard Real Estate ETF Total Return (VNQ) paints a clear picture of returns for both asset classes. Outside of the 2008 and 2020 recessions, the floor for returns on commercial real estate investments has been largely higher than the floor for traditional stocks. Additionally, the highest returns for real estate investment returns were generally higher than the highest returns generated by stocks.

What makes commercial real estate a better option?

Real estate has long been a favorite investment option thanks to the fact that people always need a place to live, and businesses always need a place to operate. Once you find a commercial investment located in a market that lends itself to successful investing, you put yourself in a position to generate a steady stream of income that requires minimal work on your part. Additionally, you aren’t at the mercy of executives and other business leaders who can make a bad decision that bottoms out the value of an investment.

Our investment strategy

Streitwise looks for investment opportunities located in non-gateway markets that are more fairly priced. Because of this better price, we are able to offer investors a better return on investment than they can receive on higher-priced properties in gateway markets like San Francisco or New York City. When those upfront prices are combined with our commitment to modest leverage (51-55% historically), we are able to offer investors a more diversified portfolio.

If you are interested in taking part in Streitwise’s investment strategy, contact us today and begin diversifying your portfolio by adding commercial real estate to your investments.