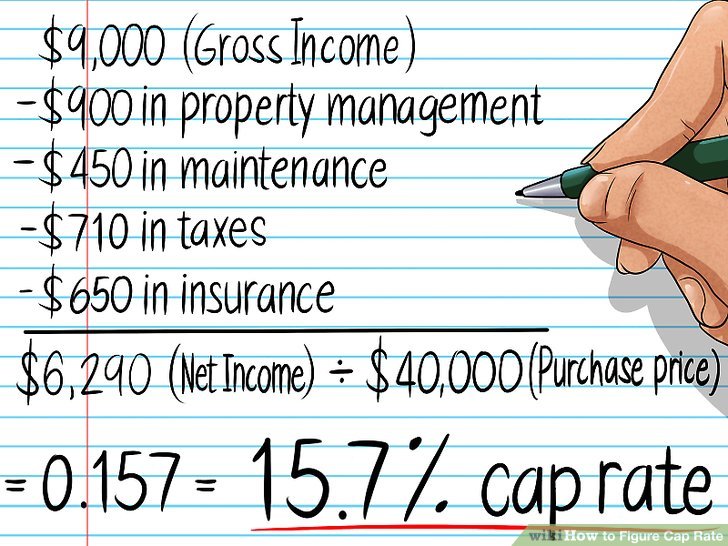

Mathematically, a cap rate is simply:

Net Operating Income, or “NOI” (revenue minus expenses) divided by the Value of the Property.

For example, if you pay $1,000,000 for a building that produces $100,000 of NOI, you’ve paid a 10% cap rate and will expect to earn a 10% unleveraged yield in Year 1, assuming no change in NOI. If that same building produces only $50,000 of NOI, then it was a 5% cap rate.

If you’re more familiar with stock market terminology, then think of a cap rate as an inverse multiple.