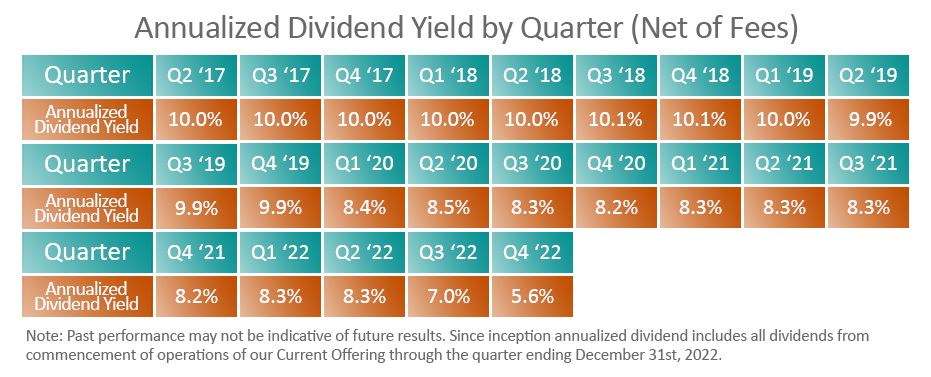

Streitwise is distributing 2Q21 dividends today equating to an 8.4% annualized yield based on the original $10.00 share purchase price and an 8.3% annualized yield based on the current NAV of $10.16/share.

Dividends will be paid pursuant to the payment option selected in your Investor Center for all eligible investors. Please allow 1-2 business days for the activity to be reflected in your account.

It’s an interesting time for the office market, to say the least. Uncertainty regarding the employee return to offices, WFH initiatives, and large increases in sublease supply in some well-known central business districts have led to sensational headlines regarding the future of office space.

Our portfolio has been resilient as we expect most of our tenants to be fully back in the office by fall.

We signed two leases this year taking occupancy at the Allied Solutions Building to 100% and are actively negotiating renewals at Streitwise Plaza (St. Louis). Leasing activity is strengthening throughout the St. Louis MSA, further supporting already-sound fundamentals for quality office space in good locations, and we expect these tailwinds to continue.

On the investing side, we see evidence that there may be opportunities to buy top quality assets at fair prices, especially relative to other property types. We will remain patient and wait for the right opportunities to acquire generational assets for the long term.