It is with great pleasure that I present to you the latest shareholder update. In this update, you will find an overview of our financials, highlights from the past year, and plans for the future. We have also launched some new initiatives that we believe will provide long-term benefits for our shareholders. We hope this update provides transparency into our operations as well as optimism in 2024.

Corporate Updates

- During 2023, the Manager of Streitwise made strategic hires to build our acquisitions team including adding Gregory Rollman, Managing Director of Acquisitions and Jonathan Etra, Vice President – Acquisitions.

- In September 2023, Greg Rollman was appointed to the Board of Directors to replace Eliot Bencuya who served on the Board since the REIT’s inception. Greg will serve out the remaining term through 2024 when he is up for re-election.

- Streitwise and our sponsor Tryperion Holdings will also be moving across town to Beverly Hills, CA. This new office will be larger than the current Brentwood office with more room for team member expansion.

Portfolio

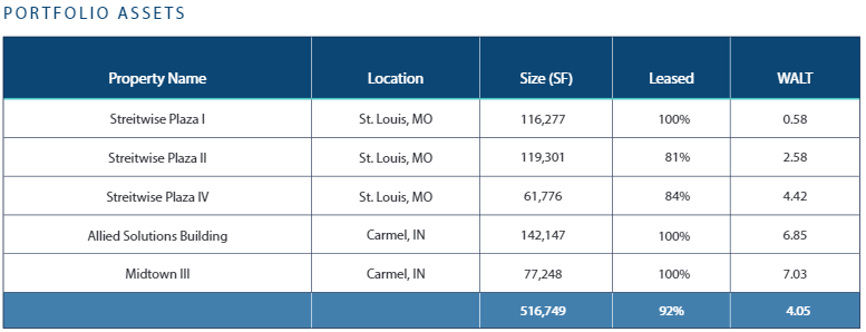

Our portfolio stands strong at 92% leased, with a weighted average lease term of 4.05 years. This marks a solid improvement from last year’s figures, which showed an 89% lease occupancy and a weighted average lease term of 3.83 years. Such progress underscores our positive leasing momentum throughout the year, bolstered not only by our existing property enhancements but also by the strategic Midtown III acquisition.

Significantly, two of our properties, Streitwise Plaza II and IV, have demonstrated remarkable resilience and growth amidst the ongoing trend of companies optimizing their space requirements. Streitwise Plaza II increased its weighted average lease term from 2.23 to 2.58, while Streitwise Plaza IV saw a more substantial jump from 1.72 to 4.42, reflecting robust leasing activities and our team’s adept management. The noted exception is Streitwise Plaza I, currently leased to Panera Bread who leaves the space in April of 2024.

Midtown III – Carmel, IN

The success we’ve experienced with the Allied building influenced our decision to increase our exposure to the Carmel market by purchasing Midtown III. Our newly-expanded footprint positions us as one of the largest owners of premier office space in the entire Indianapolis MSA, resulting in, among other things, reduced expenses and increased visibility into off-market opportunities. We believe Midtown III and the Allied Solutions Building to be two of the best office buildings in the Indianapolis MSA, if not the state of Indiana.

Midtown III is 100% leased, bolstered by a 7.0-year weighted average lease term. Long-term, in-place leases provide a steady and predictable income stream and reduce volatility.

Midtown III is currently 100% leased to the following tenants:

- MJ Insurance: 37,964 sf through 2029. MJ Insurance is a privately-held insurance agency that provides a variety of personal and business insurance solutions, as well as employee benefits services.

- Office Labs Carmel (dba Serendipity): 21,999 sf through 2034. Serendipity Labs is a high-end private office and co-working space with a reported over 90% occupancy usage by tenants.

- Element Three: 6,687 sf through 2028. Element Three is a marketing consultancy firm.

- Financial Partners Group: 5,569 sf through 2029. Financial Partners Group is a securities and investment advisory group.

- TrueBlood Real Estate: 5,029 sf through 2026. TrueBlood Real Estate is an Indiana-based real estate and property management firm.

Allied Solutions Building – Carmel, IN

The Allied Building is 100% occupied with 6.85 years of weighted average lease term remaining. Ground-floor retail tenants Java House Coffee, Renova Aesthetics, Penn & Beech, and Fork+Ale continue to perform well in this high-foot traffic area of Midtown Carmel. Demand for this microlocation has only strengthened over time.

We recently signed a lease extension with Fork+Ale to August 2034. We not only extended at a premium to their in-place rent, we also didn’t have to spend any money on tenant improvements or leasing commissions.

Streitwise Plaza (Building I, II, IV) – St. Louis, MO

We were notified last year that Panera will not be renewing its lease expiring in April 2024. Panera, which is in Streitwise Plaza I and occupies 22.5% of the total portfolio’s square footage, continues to pay rent until their lease expiration date. As a result of Panera’s non-renewal, any excess cash from operations is being swept to reserve for re-tenanting costs pursuant to the loan agreement.

In anticipation of the scheduled vacancy, we have been strategizing infrastructure modifications to transition the property from single-tenant to multi-tenant use and introduce amenities to attract prospective tenants. These calculated enhancements should positively impact leasing. We will likely have a more substantial update in Q1 2024 regarding the Panera space.

While we explore multiple avenues to fill the Panera space, the rest of the Streitwise Plaza in buildings II and IV continue to be in high-demand, as the premiere office location in South County, St. Louis. We have signed numerous new leases and lease extensions, including the extension of New Balance, the second largest tenant at Streitwise Plaza.

We recently signed the following lease renewals and new leases:

Streitwise Plaza II:

- New Balance: Lease renewal extended to March 2028

- Sunstar: Lease renewal extended to January 2025

- Edward Jones: Lease renewal extended to August 2028

Streitwise Plaza IV:

- Archer & Lassa: New lease until December 2028

- Dirxion: New lease until March 2031

- Kadean: New lease until September 2030

- FP&S: New lease until May 2029

- Edward Jones #130: New lease until June 2034

Market

Indianapolis Commercial Real Estate Market

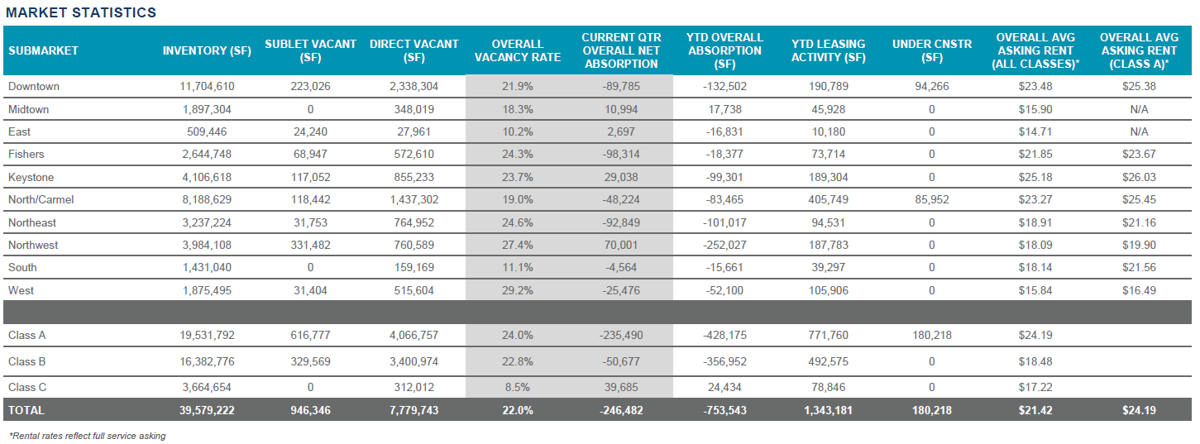

While the office market is sluggish in most of the Indianapolis MSA, it is well-known that Midtown Carmel is alive and well, and both of our properties – Allied Solutions Building and Midtown III – are in the middle of it all. By far the most leasing activity over the last four quarters has been in the North/Carmel submarket, making up over 30% of the leasing activity in the region.

The momentum continues to shift toward the suburbs in Carmel’s direction and we will continue to draft off future place-making developments and infrastructure projects locally.

Why Invest in Carmel?

Dubbed the “Best Small City in America” by WalletHub and dubbed by The Wall Street Journal as “The Internet’s Favorite Small Town”, Carmel has had been one of the biggest success stories in the Midwest. Carmel’s population has more than quadrupled since 1990 with over 100,000 residents by 2022. This Northern Indianapolis submarket is consistently lauded as one of the premier living destinations in the U.S. Both Streitwise acquisitions sit conveniently in the Midtown Carmel redevelopment corridor and make up 57% of the total office space in this area.

With neighboring residential and multifamily buildings, retail hubs, office spaces, and shared public zones (such as Midtown Plaza) and Monon trail, this corridor pulsates with life and opportunities.

Analysts expect the Midwest’s relative affordability and local amenities to keep drawing out-of-state transplants to markets like Carmel, even as the national housing market adjusts from its pandemic high. The Streitwise portfolio has benefited from the Allied Solutions Building’s success in Carmel and anticipate further success as we increase our footprint in Carmel.

Shareholders should be optimistic about investing in this successful corridor.

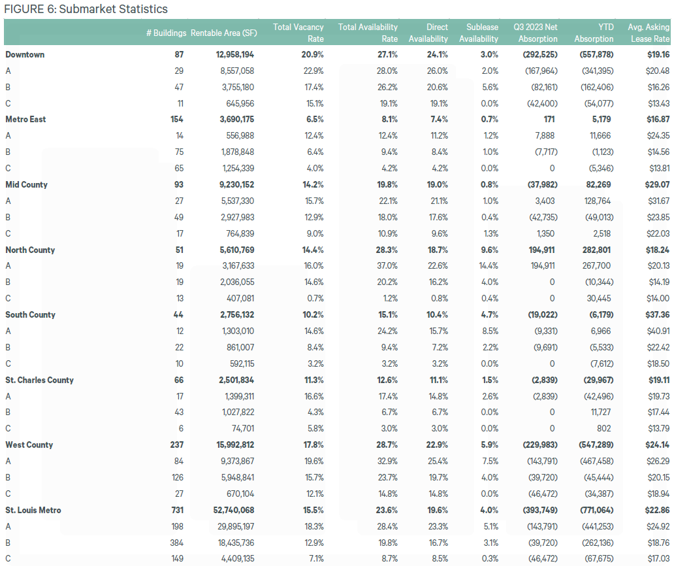

St. Louis Commercial Real Estate Market

At the start of the pandemic, tenants in St. Louis signed short term extensions to get through the immediate crisis. Now, they are either gravitating towards prime class-A office space as a part of their “flight to quality” strategy to bring employees back to a collaborative environment OR they’re embracing more of a hybrid work-from-home model.

At the start of the pandemic, tenants in St. Louis signed short term extensions to get through the immediate crisis. Now, they are either gravitating towards prime class-A office space as a part of their “flight to quality” strategy to bring employees back to a collaborative environment OR they’re embracing more of a hybrid work-from-home model.

While the work from home contingent is putting upward pressure on office vacancy, the quality buildings are not feeling that pressure nearly to the extent of the lesser quality buildings that are seeing rapidly diminishing demand.

Streitwise Plaza is the best office park in South County, which is one of the strongest submarkets in the St. Louis MSA. South County has by far the largest asking rent of any submarket in the St. Louis MSA and has the second highest occupancy rates.

Market Conditions

If there is a recession on the horizon, one risk is that we may be impacted on the leasing front if and when users look for ways to cut costs. On the other hand, we are protected in one key way: We have long-term, fixed rate debt at interest rates well below what’s market in today’s debt environment. Our Streitwise Plaza senior loan is fixed at 4.4% through June 2027 and our Allied building senior loan is fixed at 4.5% through February 2029. Midtown III is currently unlevered. These low, fixed rate loans with firm term are tremendous assets in this environment.

Our monthly debt payments are composed of interest and principal paydowns. Since the Midtown III acquisition was funded with no debt financing, the current portfolio Loan-to-Value is 42%. A conservative loan-to-value (LTV) ratio indicates a significant equity cushion, which reduces the risk of loan default and provides more stability to lenders and investors during economic volatility.

The Midtown III property was purchased through a contribution that I made to the Company in exchange for 2,532,731 Operating Partnership Units at the then current share price of $7.01. Although we did not use any debt financing to purchase the property, we are exploring our financing options to leverage ~50% of the purchase price, or ~$9m. If we can obtain financing at rates we deem reasonable, then any proceeds received from the financing will be used to first reimburse myself for my contribution.

This large investment of 2,532,731 of OP units in Streitwise further reinforces the alignment of financial interests with shareholders that is unmatched.

What to Look For

As we step further into 2024, it is with a robust and more agile portfolio and a reinforced commitment to our stakeholders. We are poised to leverage our learnings from 2023, capitalizing on our strengthened foundations to drive value for all our shareholders for the rest of the year.