I want to thank you for being a supporter of Streitwise in 2019 and continuing the journey towards financial success in 2020 and beyond. 2019 was a great year all around, increasing and diversifying our investor base, continuing to implement efficiency and user improvements for new and existing shareholders, and positive leasing momentum throughout the portfolio.

Product Improvements

Key 2019 developments include:

- Individual shareholders now have the ability to make recurring investments and gradually make additional purchases on a set, monthly schedule using auto-invest.

- Expanded the number of IRA custodian relationships and developed direct lines of communication to assist funding IRA accounts.

- Through Computershare, the investor center is now mobile optimized and easier to access from your smartphone.

Investment Amount

Our investor base grew by over 100% in 2019, with over 40% of all investors enrolled in dividend reinvesting. Total fundraising more than tripled from 2018 to 2019 with 4Q19 being the best quarter in company history – just in time for our annual Invest for a Cause campaign. We are proud of that vote of confidence and proud that we can change lives by making available private commercial real estate opportunities to all investors.

New Partnerships

We continue to explore potential partnerships with larger investors and we will see how those opportunities develop as we acquire more assets. Furthermore, we are focused on producing additional video and blog content so that our shareholders have more access and interaction with our executive team, our philosophy and our real-time thoughts.

Portfolio Changes

The Allied Solutions Building acquisition was by far the most important change to our portfolio this year.

- Located in Carmel, Indiana — a burgeoning Indianapolis suburb — the property is situated in a redevelopment area that continues to improve rapidly as new apartments, office buildings and public amenities are completed adjacent to our anchor project.

- The public plaza opened this summer and is a hit with the local community. We have signed three ground floor retail leases since closing, bringing the project to 93% leased and adding an estimated $2.4mm of net operating income to the building.

Lease Expirations

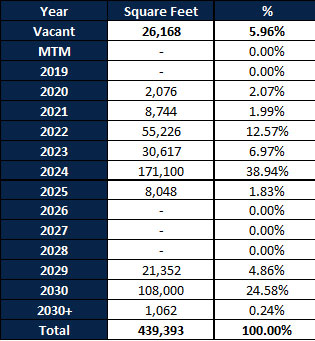

Lease Expirations

Our lease expiration schedule is one of our greatest strengths, with minimal rollover until 2022-2024. We will begin to explore the possibility of early renewals with some of our larger tenants, but thanks to some very long lease terms at our Allied Solutions Building, we have diversified and mitigated our rollover risk for the entirety of the new decade. The chart below illustrates our current lease expiration schedule.

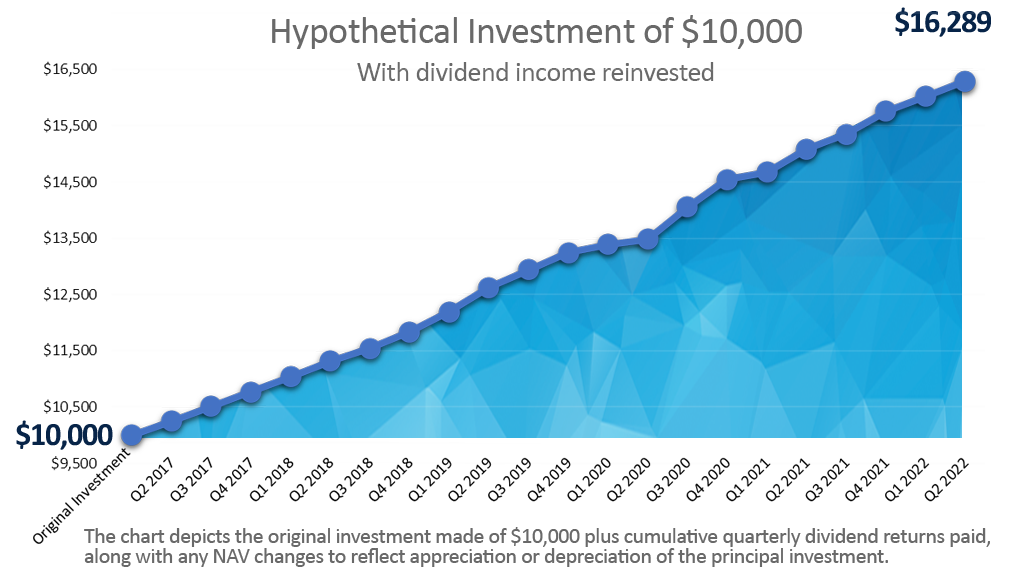

Dividend returns

Our ability to drive occupancy and control expenses has enabled us to deliver 10% annualized dividends since inception. In addition, we have driven further shareholder value by maintaining a positive NAV trajectory. We are pleased with our performance to date, but in no way are we satisfied. We will continue to work hard to optimize performance and to curate a desirable portfolio.

2020 Outlook: New acquisitions, improved balance sheet for long-term growth, adjusted yield, enhanced investor communications

The acquisition pipeline remains robust, but pricing remains elevated so we must be judicious in deploying capital. We do not intend on sacrificing quality or location to chase yield. At the same time, we will not pay any price to acquire a desirable property. Phoenix, Minneapolis, and Indianapolis are currently very active markets.

Cash-on-Cash yields are likely to trend down in the near term. Why?

- Loan principal paydown → NAV gains: Our Streitwise Plaza loan has recently entered its amortization period, which will also affect the after debt service cash flow available for dividend distribution. This cash flow is specifically being used to pay down the principal balance on a 25-year amortization schedule, so any dividend resulting from this principal paydown will ultimately lead to a healthier balance sheet.

- Near-term property-level investment → future revenue generation: We are currently budgeting over $1.1mm of capital improvements across the portfolio, including approximately $600,000 at Streitwise Plaza to keep the property in Class A condition, as well as investing $500,000 into the tenant suites at Allied, for both currently signed leases as well as speculative investment to drive further occupancy of the remaining office suites. Continued investment in properties generates new leasing activity and helps tenant retention.

We forecast 2020 dividends to be in the 8.0-9.0% range.

Other 2020 goals:

- New acquisitions for the Streitwise offering in targeted secondary markets.

- Enhanced communication between Streitwise investors and the Investor Center. We now have dedicated personnel at Computershare through phone and email that are able to handle investor-related issues.

- Improved enrollment process for IRA custodian holders as well as LLC holders and international investors.

- More content from Streitwise. We made changes to the brand including a new logo and new content will follow these changes. We aim to create high-quality videos about the market at large.

Overall, we are excited about creating the first REIT focused on sub-institutional, modern, mixed-use, walkable -suburban-urban cores within secondary markets.

We are still laser focused on our downside. Acquiring buildings in desirable suburban-urban (also called “middle neighborhoods” or “surban”) locations nodes with quality tenancy will ensure cash flow growth and stability for years to come. We think it epitomizes the world to come in suburban life.

Our investment strategy and our thesis remain the same: We believe that buying quality, stabilized office buildings in desirable suburban-urban locations at high cap rates will result in outsized risk-adjusted returns over the long term.

Here’s to a prosperous 2020. We hope to do well for, and right by, the Streitwise community.

Eliot Bencuya,

Co-Founder and CEO

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.

Lease Expirations

Lease Expirations