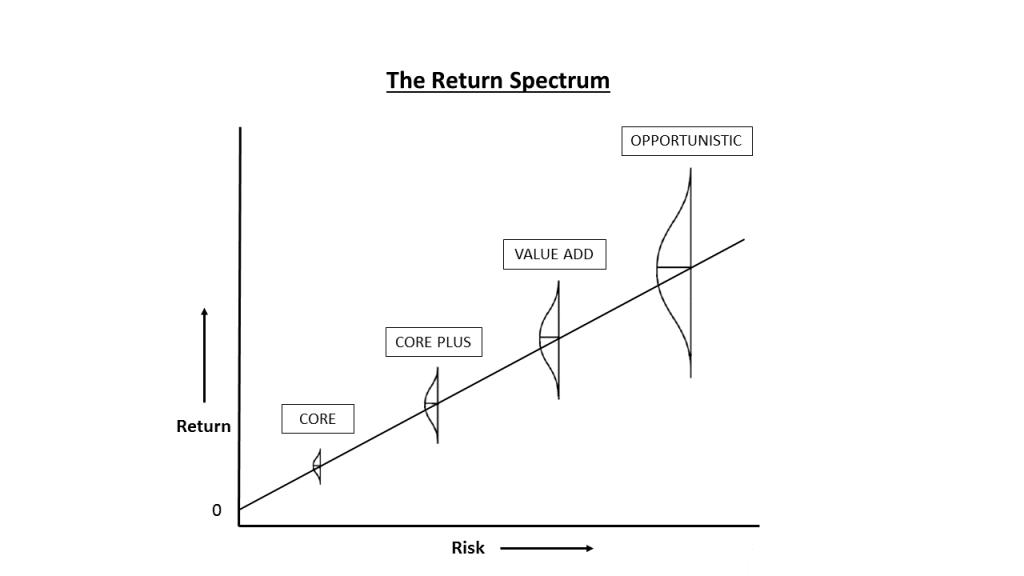

When real estate investors talk about different return targets, the terminology can become a bit confusing. But with only minor additions to your financial vocabulary, the real estate investment return spectrum is actually quite easy to understand. Generally speaking, different investors target different returns based on the risk associated with generating those returns. In real estate, there are four levels of return targets: Core, Core Plus, Value Add, and Opportunistic. Here’s how they break down:

- Core investors target 4-7% returns in deals that pose minimal risk. These deals are normally “Trophy” or “Class A” properties in strong markets with little risk of diminished cash flows. In short, they’re properties that should at the very least hold their value over the long term.

- Core Plus investors target 8-12% returns in deals that pose a moderate level of risk. This includes strong properties with only a few relatively minor risk elements, such as being located in a secondary market or being less than “Class A” in quality.

- Value Add investors target 13-17% returns in deals that are higher risk. These deals usually exhibit at least one “value add” component, whether it’s increasing occupancy from 50% to a stabilized level, or perhaps by repositioning a property that had physically deteriorated under prior ownership. In any event, the “value add” proposition usually entails stabilizing an underperforming property.

- Opportunistic investors target 18%+ returns in deals that are very risky. Casual investors who are unable to absorb significant principal loss should be wary of these types of deals. They’re often land or development investments that involve entitlement risk, construction risk, market risk, and/or timing risk (among others). The potential reward could be substantial, but a lot needs to go right in order to successfully achieve such outsized returns.

The goal of any investor, no matter the return target, should always be to do deals that are attractive on a risk-adjusted basis. For instance, a 10% return is a fantastic outcome for a deal with a core risk profile. But that same 10% return is a very mediocre outcome for an opportunistic deal. It’s all about risk-reward.