At this point, you are no doubt being bombarded by articles and financial mailers sounding the alarms on the prospects of inflation.

Inflation sounds scary, except that it’s a terminology so muddled by whatever narrative it is being used to support, that for all intents and purposes it has approached meaninglessness. Most of the inflation content generated in the last few weeks conflates so many different factors that one cannot even have a reasonable conversation about its existence, let alone an actionable one about its practical implications.

Inflation sounds scary, except that it’s a terminology so muddled by whatever narrative it is being used to support, that for all intents and purposes it has approached meaninglessness. Most of the inflation content generated in the last few weeks conflates so many different factors that one cannot even have a reasonable conversation about its existence, let alone an actionable one about its practical implications.

So let’s slow down and simplify. There are many factors beyond inflation that affect how much something costs. Primarily, supply and demand. Perhaps we can say that inflation is in the background then, a phenomenon that increases the overall price level of acquiring goods/services/assets and reducing the cost of extinguishing liabilities/obligations.

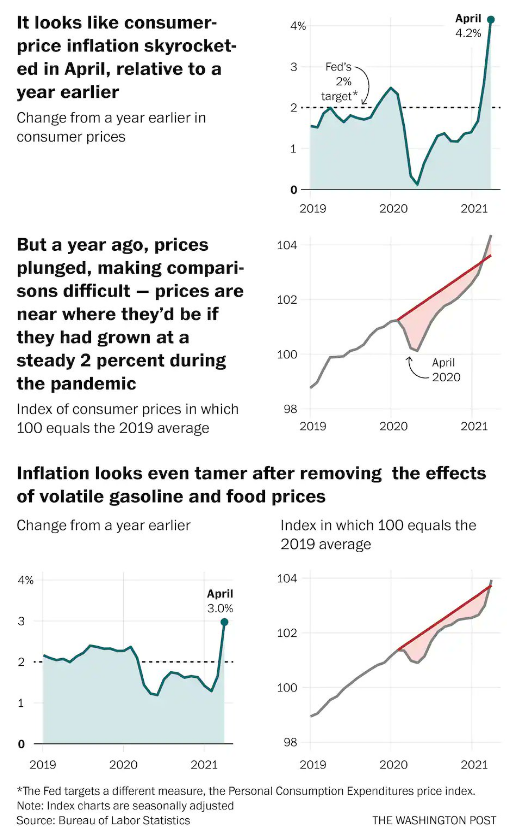

What’s causing the most recent flare up in inflation talk are the recent prints of consumer price index (CPI) increases, rising 4.2% in April, the fastest year-over-year change since 2008.

But before everyone freaks out, we have to realize that:

- There was something pretty big going on last April with a global pandemic that interrupted both supply chains and demand.

- Turning the economy off and on again ought to come with an expectation of aberrational outcomes in the short term. For example, used car shortages and price increases were a huge contributing factor. Other notable products with similar shortages and consumer price hikes include lumber and gas.

Whether the acceleration in inflation trends is transitory or persistent remains to be seen, but a portfolio allocation to investments that protect against stronger than expected inflation doesn’t need to hinge on the outcome, nor does it need to consume an entire investment philosophy.

How do I protect my portfolio in the event we do get significant inflation? Why is real estate a standard choice for investors?

The answer ultimately lies in the pricing power of real estate owners and the ability to charge increasingly higher rents. And that is a matter of localized supply and demand for a particular property type in a particular location, and the price paid to generate the desired return. The focus should first and foremost be fundamentals and basis, with inflation protection a secondary outcome.

Real estate: A natural hedge against inflation

One of the most direct reasons real estate can properly hedge general inflation risk is its ability to support long term, fixed rate debt financing. Supply and demand aside, this type of leverage in an inflationary regime is indisputably a win for property owners. Short term, floating rate financing, less so.

Which is why, whether inflation runs hot or not, having real estate in your portfolio that includes these characteristics will help you sleep well at night:

- Pricing power

- At the right basis

- Appropriate downside protection

- Paired with appropriate leverage

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.