“If you don’t know who the bag holder/patsy at the table is, it’s probably you”

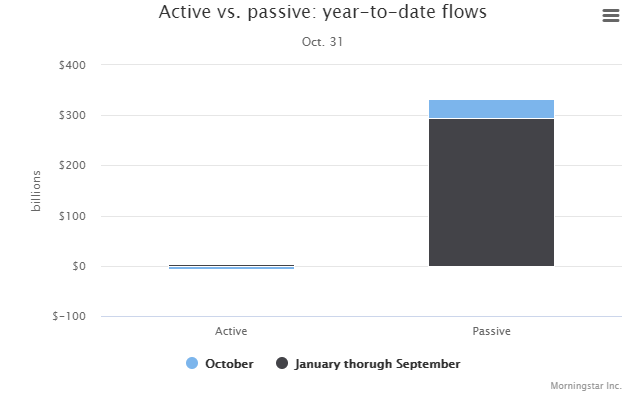

When it comes to buying individual stocks, indexing and passive investing have become the topic of the decade in the world of personal (and corporate) finance. As investors matured into a self-awareness and acceptance (for now) of their inability to beat the market, fund flows have poured into index ETF’s and other passive vehicles at the expense of individual stock picking.

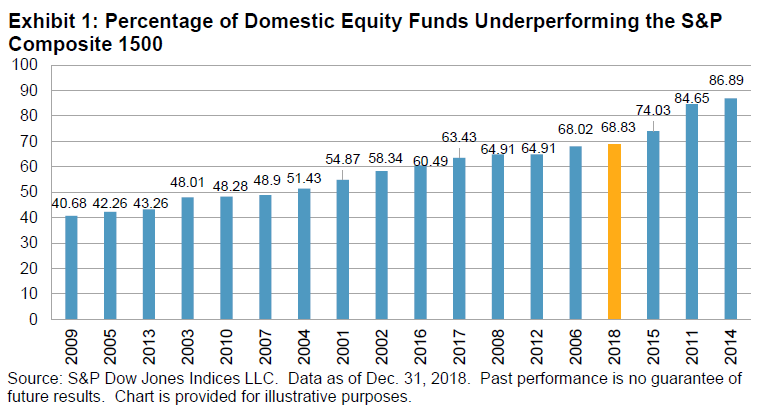

And with good reason… Non-professional stock investors (and candidly many of the pros too) are simply unable, over any reasonable length of time, to consistently pick more and bigger winners than they do losers, resulting in under performance against a boring market index. Yep, we said it, indexes are boring, it’s true! But boring is what leads to a comfortable retirement, or enough funds for your child’s college 529, or just some supplemental income to fund a family vacation. Sitting on the edge of your seats to find out what happens at the end should be reserved for M. Night Shyamalan’s next movie, not for what your IRA balance looks like in 10 years.

Why should it look any different for markets not listed on any exchange? To the extent you’ve already determined to allocate a portion of your portfolio to alternative investments and private commercial real estate, are you really able to pick and choose one-off investments any better than you are able to choose individual stocks?

Commercial real estate, along with most asset markets, have had an incredible run over the past decade. Given the breadth of the strength in asset price appreciation, throwing darts to select individual commercial real estate investments has generated returns that make investors incredibly confident in their ability to choose winners. “How’d you do so well in your real estate portfolio? Well, I’m really good at darts you see,” said no investor ever.

Risk in any individual deal has been papered over by widespread growth. Properties purchased with little margin of safety have produced outcomes leading investors to pat themselves on the back, turning a blind eye to the potential paths that did not materialize, those which would have resulted in a permanent impairment of invested capital.

So ask yourself:

- Do you know how much luck is priced into your Sponsor’s 18% IRR forecast for the project in which you’re investing, and what happens to your principal if those assumptions are wrong?

- Do you know how much upside you’re foregoing with the Sponsor’s profit share splits?

- Do you know how much downside you’re subject to compared to the Sponsor’s investment after fees?

- Do you know how highly the Sponsor can leverage the property and still refinance in the event that adverse conditions persist when the loan matures?

If you cannot answer those questions with confidence, if you cannot get a direct answer from the Sponsor to specific underwriting questions, if you cannot fully roll your debt without an additional capital infusion during downturns, then ask yourself, is this what you should be doing with your hard-earned capital?

Investors seem to have learned their lessons regarding stock picking in the public markets, but for some reason that does not seem to have translated to private markets and alternative investments recently accessible to a wider pool of investors. There’s no reason to take those same lumps again, the writing is on the wall.