While a real estate investment offering can claim to be low cost if it doesn’t charge investors any up-front fees, the sponsor and manager can charge the offering fees, making “low fee” or “zero fee” claims as disingenuous.

A typical practice in structuring commercial real estate transactions is a joint venture between two parties:

- Party A, commonly known as the Sponsor, Operator or General Partner (GP), makes day-to-day property level decisions, oversees the property manager, supervises improvement projects and generally executes the on-the-ground aspects of a business plan.

- Party B, commonly known as the Limited Partner (LP), provides most of the equity capital necessary to fund the acquisition and any planned value-add strategy.

The idea here is simple: The Limited Partner relies on the Sponsor’s expertise in executing the business plan. Now, if you were the Sponsor putting in sweat equity so the Limited Partner can enjoy passive returns, you likely won’t work for free! Let’s introduce a variety of methods commonly used to compensate the Sponsor for its sweat equity and operational oversight.

Transaction Fees

- Acquisition / Asset Origination Fee: As simple as it sounds, this is generally calculated as a percentage of the purchase price and for the most part ranges from 0-2%.

- Financing Fee: Not as common as acquisition fees, but still found in the wild. For the most part, ranges from 0-1% and is calculated as a percentage of the initial loan balance.

- Disposition Fee: Disposition fees if a property is sold, creates the incentive to sell a property even though it may be in REIT investors’ best interest to retain.

Management Fees

- Asset Management Fee: This one can vary, but is usually either a fixed monthly dollar amount, a percentage of revenues, or a percentage of the equity capital invested. The idea here is to compensate the Sponsor for dedicating its employees and time to managing the asset. Note: This is NOT a property management fee, which we’ll assume is a third party provider, but rather means overseeing strategy, leasing, reporting, etc.

- Construction Management Fee: If there is renovation work to be done, or tenant improvements, or other capital expenditures, and your property manager is not tasked with overseeing the work (or sometimes, even if they are), you’ll find sponsors asking for this fee. What’s reasonable? It depends, but imagine a sliding scale from 1-5% depending on the size of the work necessary (smaller jobs -> higher percentages).

- Leasing Fee: You’ll also find sponsors asking for this even if there are third party leasing agents on the assignment. Why? The why behind any of these fees is, because they can, and because Limited Partners don’t ask. Especially smaller groups of Limited Partners with less negotiating leverage.

Waterfall / Profit-Sharing / Promoted Interest / Carried Interest Fee

Assume for a moment that of the equity required for a given investment, 90% of it comes from the Limited Partner, and 10% comes from the Sponsor. How should distributions be split? 90/10? A very common profit-sharing agreement in real estate joint ventures comes in the form of an uneven sharing of cash flows. For example, equity might be invested 90/10, but distributions could be split 70/30.

An investor may say that isn’t fair, and that investor is probably right. Which is why we find a practice called the “waterfall.” The waterfall, or incentive fee, is a profit-sharing mechanism in which profits are shared unevenly, but only above a specified minimum return on the investment. Which is to say, an investor is happy to share more profits with the Sponsor, but only if they have received a 10% return on their capital, for example.

What is a standard waterfall? Wish we could tell you. It’s one of the most negotiated items in a joint venture, that range from:

- Obscene: Huge profit share to operating partner, low return hurdle

- Quite reasonable: Investor receives solid return and thereafter shares a portion of the returns.

In any case, a waterfall is money out of the Limited Partner’s pockets had they executed the transaction directly without an operating partner.

Sowing confusion – Shedding light to hidden fees

The summary is that Limited Partner’s pay for the benefit of not doing the work themselves. What they pay and how much they pay, as you can see, varies greatly. And hopefully, YOU, the investor, are informed enough to be able to ask the proper questions. But there are ways to hide fees! And unless one knows where to look, the investors are charged these fees without even knowing about it.

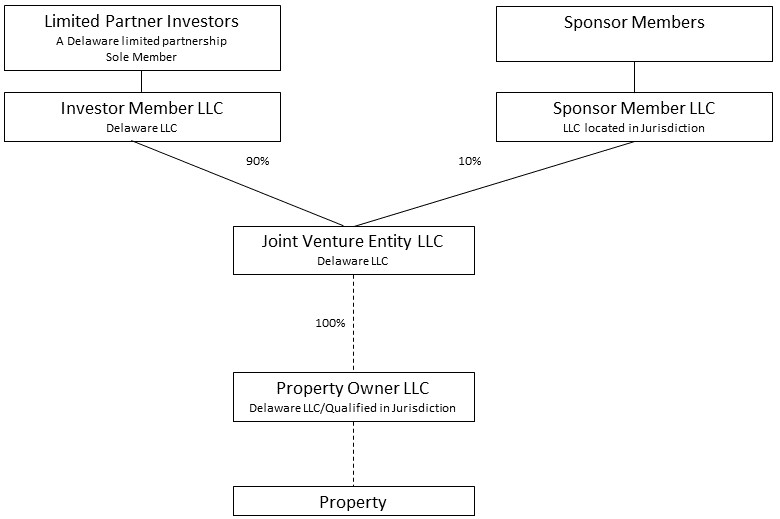

It all comes back to the joint venture format:

- Are you investing with the real estate operator directly?

- Or are you investing with a firm/website that aggregates investor capital, and subsequently invests with a real estate operator?

I hate to tell you this, but it’s likely the former (unlike Streitwise, where you’re investing directly with the operator). Why is this distinction important? Because it means that the company you’re investing with (let’s call them the Aggregator) can tell you: “We don’t charge acquisition fees” or “No profit sharing waterfall here” all the while misleading you that the real estate operator that ultimately manages the asset does charge those fees.

An example of how fee structures can be manipulated to look lower to retail investors than they actually are.

- Scenario: A property is acquired for $30mm through a combination of $20mm of debt and $10mm equity.

- Aggregator fees: You invest with a group, let’s call them Aggregator, who charges an asset management fee of 1% a year on equity and raises a total of $9mm.

- Aggregator – sponsor relationship: Aggregator then takes that capital and invests in a joint venture with the sponsor, who contributes $1mm of equity.

- Sponsor fees: Suppose sponsor charges a 2% acquisition fee (a one-time fee of $600K), a 1% financing fee (a one-time fee of $200K) and an annual 1% asset management fee ($100K per year).

- Aggregator & sponsor profit sharing: Suppose further that the cash flows are split 50% to Aggregator and 50% to sponsor.

- Result: That’s $800K right off the top, $100K per year, and 50% of the upside that will NOT flow to the investors who invested with the Aggregator. And yet, the Aggregator can still claim that they only charge fee a 1% management fee. The joint venture hides fees! No matter how you slice it, fees paid to an operator, even if you are not investing directly with them, is money out of an investor’s pocket. If it weren’t for that fee, the money would be available for you.

Using a real-life example using an unnamed REIT competitor that openly advertises “zero platform fees” and says their fee structure is the lowest:

- Organization and Offering Expenses: Yes; “The Company engages third parties to provide a variety of other services, including insurance and marketing. If the Manager is able to engage third parties at lower-than-market rates, then the Manager is entitled to retain the difference. The Manager will determine the market rates for the services in question — and thus its own compensation — based on its experience in the real estate industry and, if it believes necessary, by reviewing proposals from other providers of such services.”

- Asset Management Fee: 2% of equity dollars per year

- Acquisition Fee: 3% to the aggregator for each acquisition the REIT makes

- Developer Fee: 6% to 8% of both hard (e.g., real estate, construction, renovation) and soft (e.g., professional fees) costs

- Construction Management Fee: 7.5%; if Sponsor provides construction management services

- Financing Coordination Fee: 1% of any loan amount

- Returns from Co-Investment: Yes

- Acquisition / Asset Origination Fee: 1-4% of total cost of asset

- Guaranty Fee: 0.5%; The amount of the guaranty fee will depend on the amount of

- Waterfall Fee: Yes; “The Promoted Interest is paid in two levels: first, after Investors have received a 7% preferred return on their investment, the Sponsor is entitled to a catchup return equal to approximately 53.85% of the preferred return paid to Investors; and second, after Investors have received their preferred return and the Sponsor has received its catchup return, the Sponsor is entitled to 35% of the remaining profits.”

- Redemption Fee: No redemption policy; can not sell before investment terms

And these are the fees that you have to dig into their Offering Circular to catch. They are not openly advertised. Here’s a visual of this Offering compared to Streitwise:

| Fee | Streitwise Offering | Competitor Offering A |

| Up-Front Fee / Organization + Offering Expenses | ||

| Asset Management Fee | ||

| Redemption Fee | ||

| Waterfall / Profit-Sharing / Promoted Interest | ||

| Developer Fee | ||

| Construction Management Fee | ||

| Financing / Financing Coordination Fee | ||

| Returns from Co-Investment | ||

| Disposition Fee | ||

| Liquidation Fee | ||

| Acquisition / Asset Origination Fee | ||

| Guaranty Fee |

Streitwise has no hidden fees

Investing with Streitwise means you own your percentage interest of the REIT’s portfolio – without further layers of fees and profit sharing squandered to third-party sponsors. We are the sponsor and charge a 2% annual fee. An investor does not lose 2% of their investment annually as a result of this fee, the fee is typically taken out of the dividend payment.

All dividends quoted have been net of fees. We do not charge any other fees such as waterfall / profit-sharing fees, acquisition fees, developer fees, construction management fees, servicing fees, liquidation fees, property management fees, financing fees, disposition fees, or any other hidden fees that other non-traded REITs often hide from prospective investors by burying the hidden fees in the offering documents.

We don’t advertise to investors: “No acquisition fees, financing fees or disposition fees”, only to turn around and invest in a joint venture where a sponsor charges those same costs at the expense of your return. We’re not paying a double asset management fee to a third-party operator. Yes, it can be complicated, and yes, if you know where to look and what questions to ask, you can determine whether an investment is funneling your profits into the pockets of others.

What other’s have said about Streitwise fees:

- The Real Estate Crowdfund Review, a non-affiliated rater of real estate platforms rated Streitwise as the Best Fees out of all Core-Plus REITs open to non-accredited investors.

- The Motley Fool: “Fee structure aligned with investors”

- TheCollegeInvestor: “Transparent fee structure” / “One thing that we like about Streitwise is that it has very transparent fees especially compared to other platforms.

- WalletHacks: “There are no hidden fees, like advisory, disposition, waterfall, or loan service fees. There are also no commission fees involved in the purchase of your investment in the trust.”