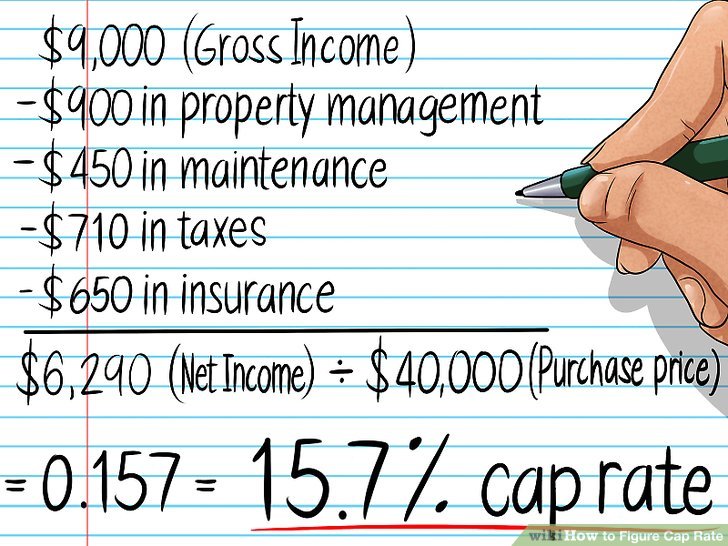

Mathematically, a cap rate is simply:

Net Operating Income, or “NOI” (revenue minus expenses) divided by the Value of the Property.

For example, if you pay $1,000,000 for a building that produces $100,000 of NOI, you’ve paid a 10% cap rate and will expect to earn a 10% unleveraged yield in Year 1, assuming no change in NOI. If that same building produces only $50,000 of NOI, then it was a 5% cap rate.

If you’re more familiar with stock market terminology, then think of a cap rate as an inverse multiple.

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.