I want to thank you for being a supporter of Streitwise in 2020 and continuing the journey towards financial success in 2021 and beyond. In spite of a difficult year defined by the pandemic, Streitwise and its investments performed well.

2020 Overview

We are incredibly fortunate to have a portfolio that has so far weathered the economic headwinds. Here were some of our best moments during 2020:

- With only minor lease accommodations early on, our tenants have paid as budgeted with nearly 100% collections. In a year where downside protection was of paramount importance, our continued focus on maintaining a quality rent roll has worked well for the portfolio.

- We paid dividends in line with our 8-9% target for 2020, continued investing in the physical condition of our properties, further paid down our senior financing, and were able to perform within 1% of budgeted NOI.

- While we were able to honor 100% of the redemption requests, we were pleased that our investor base largely maintained its discipline and trusted us enough not to rush for the exits. We appreciate and do not take for granted this confidence in our team and our long-term investment approach.

Product Improvements

Key 2020 developments include:

- Hired new staff. We are pleased to announce the recent hiring of Sandra Dickson, who joins us most recently from her tenure as an asset manager at Westfield.

- Expanded the number of IRA custodian relationships and developed direct lines of communication to assist funding IRA accounts.

- Completed early phases of beta testing a mobile iOS app for investors to track their investment progress and add more funds.

Acquisitions & Market Outlook

We continue to believe, as we did when we launched Streitwise, that suburban-urban office properties will outperform, that top tier office properties hold value best in downturns and emerge first during recoveries, and that quality revenue from credit worthy tenants is more important now than ever. We continue to seek out opportunities with these three fundamental pillars.

Location:

- Amenities & walkability

- Secondary markets

- Suburban-urban (also called “middle neighborhoods” or “surban”)

Quality:

- Top tier office properties

- Strong tenant credit profile

Value:

- Pricing on select properties in need of investment may be attractive

- Invest in structured positions to borrowers that need capital

The investment sales market, much like the leasing market, has been in a near freeze as buyers await discounts and sellers refuse to budge while in-place leases generate current cash flow and maturing tenants mostly renew for short terms.

For the most part, the only office properties that have continued to trade are those with rent rolls that exhibit both strong credits and significant term, which has been highly influenced by lower interest rates. Lenders are offering incredibly attractive long-term fixed rates for long-term leased assets, and buyers have been happily obliging.

For more traditional multi-tenant, typical expiration assets, both lease rates and investment sales are in price discovery, and we believe the thaw and a new equilibrium will happen slowly.

Portfolio Changes

The portfolio continues to generate significant cash flow capitalized with total secured senior financing of approximately 51% LTV. The properties in the portfolio are on much firmer footing than their coastal, tech-centric counterparts – in particular with respect to sublease availability – and we hope that cushions the landing as we approach 2021-2022.

Streitwise Plaza (St. Louis, MO):

- Continues to be nearly full approaching 98% occupancy.

- Despite the negative absorption, we actually signed three lease deals this year, including an extension, an expansion/extension, and a new lease.

- We made capital expenditures necessary to maintain the property as a top tier asset and have further CapEx budgeted for 2021.

- We are aggressively marketing the limited vacancies for lease.

- We will begin discussions with tenants to see if we are able to create any early extensions where it may be mutually beneficial.

Allied Solutions Building (Carmel, IN)

- We fully leased the ground floor retail portion of the Allied Solutions Building, leaving only a couple of office suites remaining on which we have active discussions ongoing.

- We believe this is one of the pre-eminent office properties in the entire Indianapolis MSA, and have no expirations until 2029.

- We have been able to maintain strong relationships with our retail tenants offering only minor modifications and we anticipate our retailers to be a real strength during the recovery.

- Java House Coffee Shop opened and Renova Aesthetic Spa is nearing completion.

- We have a unique mixed-use property in the heart of a major pedestrian suburban-urban pocket, a strong contributor to our 2021 cash flow.

Lease Expirations

With respect to our portfolio’s lease expiration schedule, we are on solid footing and have strong anchor cash flows extending through 2030 with no major roll before 2024. This provides time for leasing velocity to stabilize and gives us runway to work with existing tenants to the extent we are able to renew them early. The chart below illustrates our current lease expiration schedule.

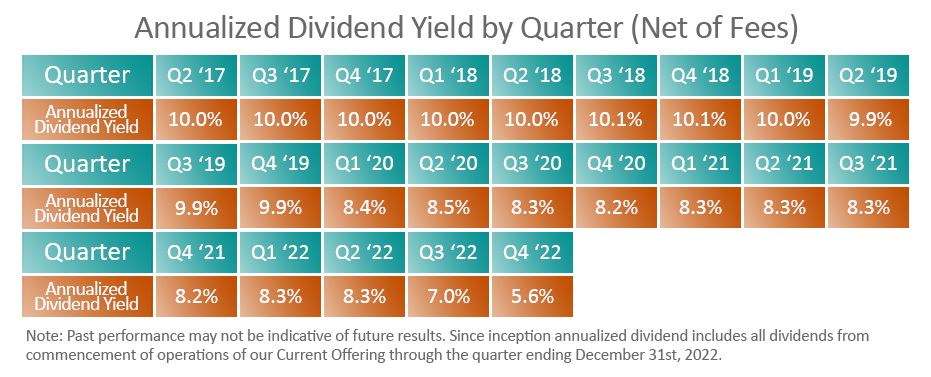

Dividends

Our ability to drive occupancy and control expenses has enabled us to deliver healthy dividends since inception. We were able to achieve our dividend target of 8-9% in 2020, and we maintain the same target for 2021. We are pleased with our performance to date, and will continue to work hard to optimize performance and grow a diverse portfolio.

2021 Strategy: Pay Down Debt, Invest in Systems, Grow Portfolio

While we await the fatter pitches for capital deployment, we will continue to do the following:

- Loan principal paydowns

- Make necessary capital expenditures to position for future revenue generation

- Plan to grow our team with new hires

- Develop a mobile iOS app for investors to facilitate managing their accounts – currently in the beta testing phase and targeting a mid-2021 release date

We are targeting 2021 dividends to be in the 8.0-9.0% range

Overall, we are excited about creating the first REIT focused on sub-institutional, modern, mixed-use, walkable urban-suburban cores within secondary markets.

Our investment strategy and our thesis remain the same: We believe that buying quality, stabilized office buildings in desirable urban-suburban locations will result in outsized risk-adjusted returns over the long term.

Here’s to a prosperous 2021. We hope to do well for, and right by, the Streitwise community.

Eliot Bencuya,

Eliot Bencuya,

Co-Founder and CEO

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.