2020 highlights: Strong performance through year defined by global pandemic

I’d like to spend a few minutes providing some general real estate market updates and the status of the existing Streitwise portfolio, and our strategy for 2021. To view the Annual Shareholder’s Meeting, click here.

We all know that 2020 was an exceedingly difficult year on a personal level, and for many, a trying year on a professional level. We are incredibly fortunate to have a portfolio that has to date performed admirably well considering the headwinds for the economy generally, and office use specifically.

With only minor modifications in the Spring of 2020, our tenants have paid as expected and budgeted with collections near 100% with minor modifications. Our focus on the quality of our tenants is specifically to protect ourselves from big downside risks, and this year has exemplified the benefits of a resilient tenant base.

We are very proud of the fact that we paid dividends as targeted at 8-9% going into 2020, continued to invest in our properties and pay down our senior loan financing, and was able to to perform within 1% of budgeted NOI in the teeth of pandemic.

While we were able to honor 100% of the redemption requests, we were very pleased with our investor base for NOT redeeming shares en masse. We believe this means there is confidence in trust in the management and the portfolio going forward.

The state of office property: Streitwise outperforming broader market

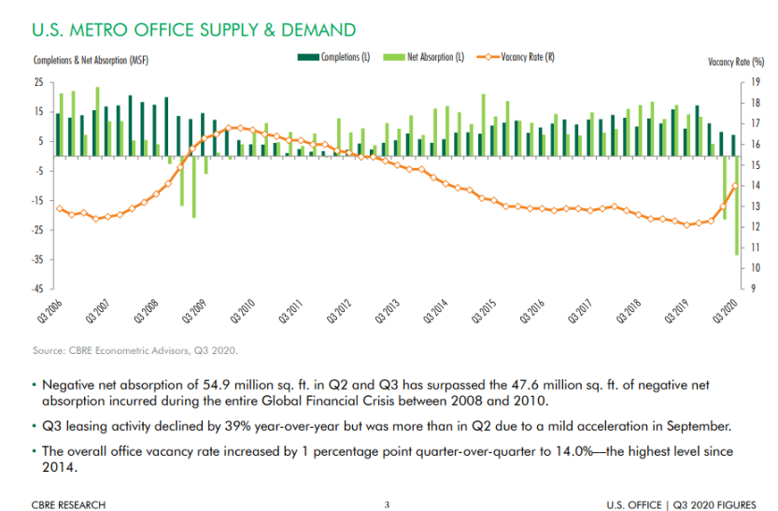

The overall picture for the US office property market was clearly less encouraging. Stagnant new leasing combined with typical expiration schedules and sublease inventory meant an increasing availability rate nationwide, although as we’ll get to later, the distribution across metropolitan areas is far from even.

We are hopeful that as vaccines are rolled out and employees begin to re-occupy office space, that the negative trends slow, but we are not expecting them to find a bottom immediately. These types of shocks have lagging effects. It was not until a full year or two after the Great Financial Crisis that office rents began an earnest rebound as occupancy tightened. And again, that was not evenly distributed across markets.

Market update: Migration patterns

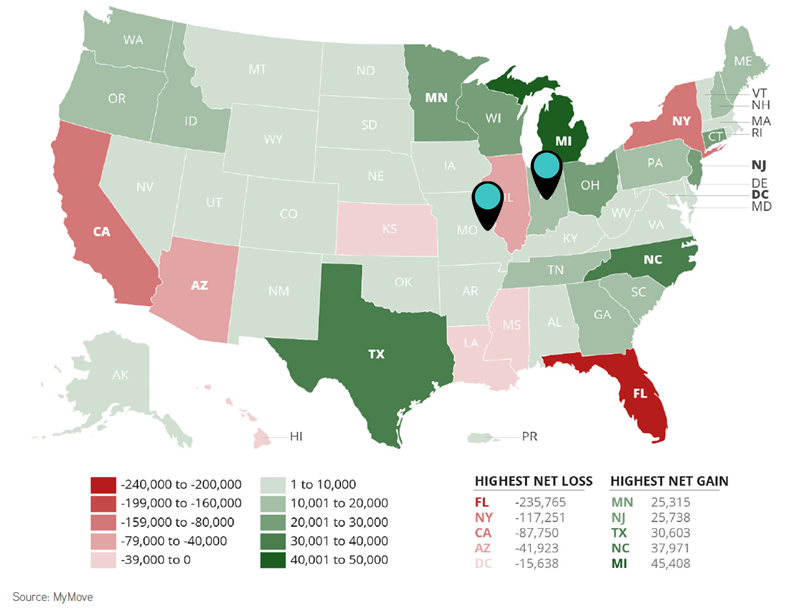

What we have seen so far, in terms of any real empirical evidence, is an acceleration of migration patterns that were already being seen pre-Covid. In particular, the move from more expensive coastal cities to cheaper alternatives has become commonplace.

While it may slow post-pandemic just by nature of a new equilibrium of housing costs, expectations are that the slow drip to low-tax, lower cost of living locales, especially with a growing technology or back office presence, is likely to persist.

Market update: Suburban outperforming Downtown locations

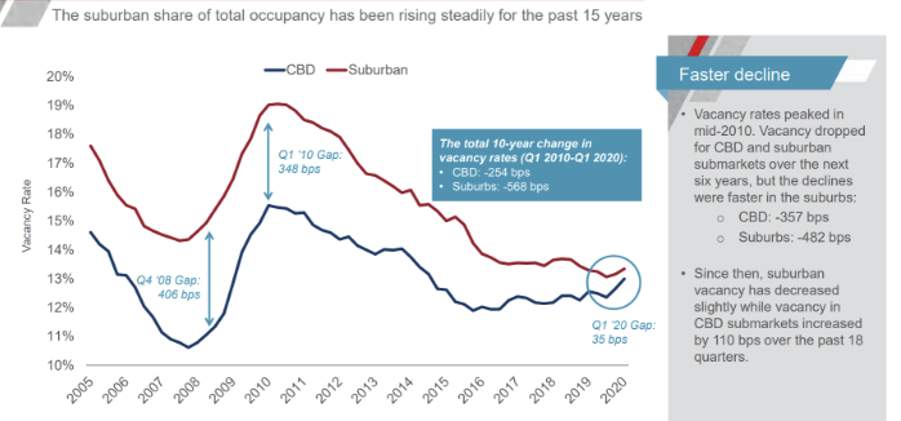

All that said, there is certainly a future for office buildings both in downtown CBDs as well as the suburbs, but there is no question that suburban office real estate is outperforming downtown properties.

The suburban share of total occupancy has been rising steadily for the past 15 years, and, thanks to the recent spike in downtown vacancies while suburban vacancy increases remain more muted, the spread between occupancy in downtown vs suburban office is approaching zero.

Market update: CRE capital markets themes – Sales market pause

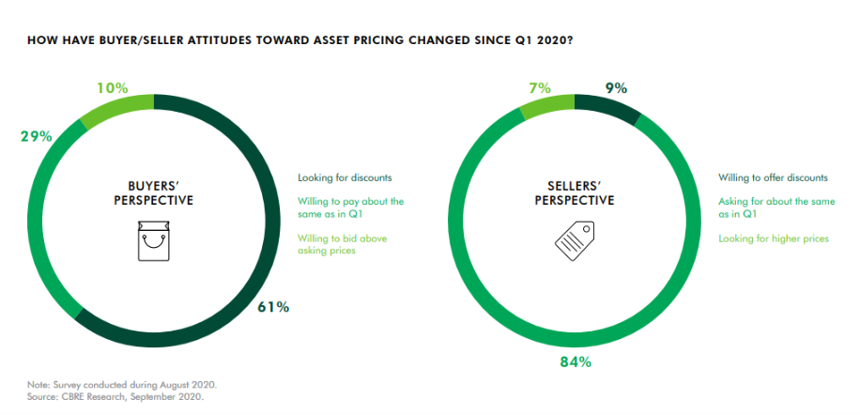

The investment sales market, much like the leasing market, has been in a near freeze as buyers await discounts and sellers refuse to budge while in-place leases generate current cash flow.

The investment sales market, much like the leasing market, has been in a near freeze as buyers await discounts and sellers refuse to budge while in-place leases generate current cash flow.

For the most part, the only office properties that have continued to trade are those with rent rolls that exhibit both strong credits and significant term, which as a result are more of a reflection of interest rates than real estate fundamentals.

Lenders are offering incredibly attractive long-term fixed rates for long-term leased assets, and buyers have been happily obliging.

For more traditional multi-tenant, typical expiration assets, both lease rates and investment sales are in price discovery, and we believe the thaw and a new equilibrium will happen slowly.

Portfolio Review: Streitwise Plaza (St. Louis, MO)

- Streitwise Plaza continues to be nearly full approaching 98% occupancy.

- Despite the negative leasing absorption in most properties, we have actually struck three lease deals, including an extension, an expansion and extension, and a new lease.

- We invested in capital expenses necessary to maintain the property as a top tier asset and have further CapEx budgeted for 2021.

- We are aggressively marketing the limited vacancies for lease, but as noted, the market is slow beyond what we were able to do.

- We will also begin discussions with tenants to see if we are able to create any early extensions where it may be mutually beneficial.

- The St. Louis office is on much firmer footing, in particular with respect to sublease availability, than its coastal, tech centric counterparts, and we hope that cushions the landing as we approach 2021-2022.

Portfolio Review: Allied Solutions Building (Carmel, IN)

- We have fully leased the ground floor retail portion of the Allied Solutions Building, leaving only a couple office suites remaining on which we have been having discussions but unfortunately nothing executed as of yet.

- We do believe this is one of the pre-eminent office properties in the entire Indianapolis MSA, and as we have no expirations there until 2029, are not concerned about filling up the remaining vacancies over time.

- Through Covid, we were able to maintain strong relationships with our retail tenants offering only minor modifications and we anticipate our retailers to be a real strength coming out post-Covid.

- Java House Coffee Shop just opened and Renova Aesthetic Spa is on its way to opening.

- We have a unique mixed use property in the heart of a major pedestrian suburban-urban (also called “middle neighborhoods” or “surban”) location, a strong contributor to our 2021 cash flow.

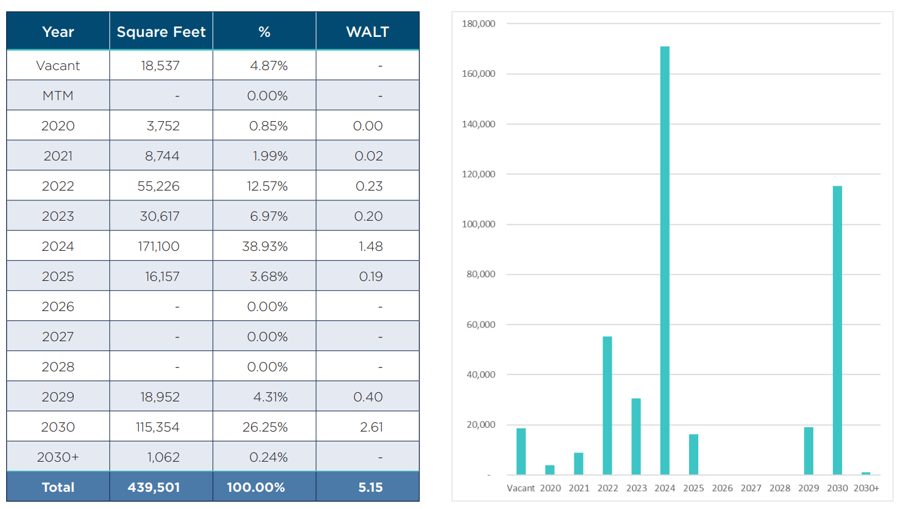

Portfolio Review: In-Place Leases

With respect to our portfolio’s lease expiration schedule, we are in a good position where we have strong, anchor cash flows out to 2030, and no larger expirations beginning until 2022.

This provides time for leasing velocity to stabilize and begin to grow again. This also gives us a runway to work with existing tenants to the extent we are able to renew them early, or provide ample time to seek out backfill tenants.

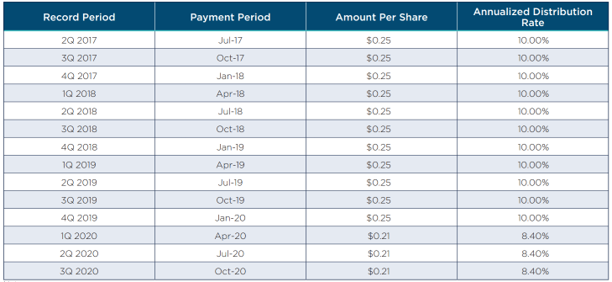

Summary: Dividend and NAV Change History

We were able to maintain our dividend target of 8-9% in 2020, and we maintain the same target for 2021.

Note: Dividend rate based on Initial Offering Price of $10/share

2021 Strategy: Additional Acquisitions

As we enter 2021, we enter from a position of strength. That said, we enter a market where stabilized long-term leased properties are very expensive, and all other investment opportunities are muted, at best. Our pipeline reflects this new environment, and we may find ourselves in a position to buy quality locations and properties with near term rollover risk at attractive prices.

We are also actively marketing ourselves as not just acquirers of property, but as providers of capital for mezzanine loans and preferred equity, where we believe we may find a growing opportunity to provide liquidity to owners at a discount to the property value. We are flexible in our approach to the markets, with the only consistent factor being that we focus on downside risks first, and the ability to generate cash flow either immediately or in the near term, second.

2021 Strategy: Pay Down Debt, Invest in Systems, Dividends, Operations

While we await the fatter pitches on the capital deployment side, we will continue:

- Loan principal paydown results in NAV gains.

- Current CapEx to position for future revenue generation.

- Shift allocation of free cash flow from current dividends towards balance sheet and property investment.

- Forecast estimated dividend range of approx. 8.0-9.0%

- Planning to grow our team with new hires. We are pleased to recently announce the hiring of Sandra Dickson, who joins us most recently from her tenure as an asset manager at Westfield.

- Developing a phone app – currently in the beta testing phase and targeting a release date of mid-2021.

Acquisition Criteria

While we previously discussed what our pipeline may look like for 2021, we want to emphasize what types of properties we believe will maintain the strongest positioning in a post-Covid world.

We continue to believe, as we did when we launched Streitwise, that suburban-urban office properties would outperform, that top tier office properties maintain value and leasing during downturns and emerge first during recoveries, and that sticky revenue from strong tenants is more important now than ever. We continue to seek out opportunities with these three fundamental pillars.

- Location

- Amenities & walkability

- Secondary markets

- Suburban-urban properties

- Quality

- Top tier office properties

- Strong tenant credit profile

- Quality Revenue

- Discounts

- Pricing on select properties may be attractive

- Invest in structured positions to borrowers that need capital

- Discount to Value

I’d like to thank everyone for participating in this year’s Streitwise Shareholder’s Meeting. To view the Annual Shareholder’s Meeting, click here.

Mr. Wills is the Marketing Director and Head of Product for Streitwise.

Prior to joining Streitwise, Mr. Wills was Head of Paid Media at Bitcoin IRA and Fortress Gold Group. Previously, Mr. Wills was the Director of Lead Generation at GTMA, a real estate marketing agency, where he founded the paid media department that oversaw a large nationwide portfolio of multifamily properties. Mr. Wills holds a Bachelor of Science degree in Marketing from the University of Florida.