I want to thank you for being a supporter of Streitwise and for continuing with us on your journey towards financial success in 2019. 2018 was a year in which we made major strides in improving our offering and maintained a healthy dividend for investors. In a year where most asset classes experienced significant headwinds – including publicly traded REITs, bonds, and stocks – Streitwise stood tall.

2018 – The Year That Was

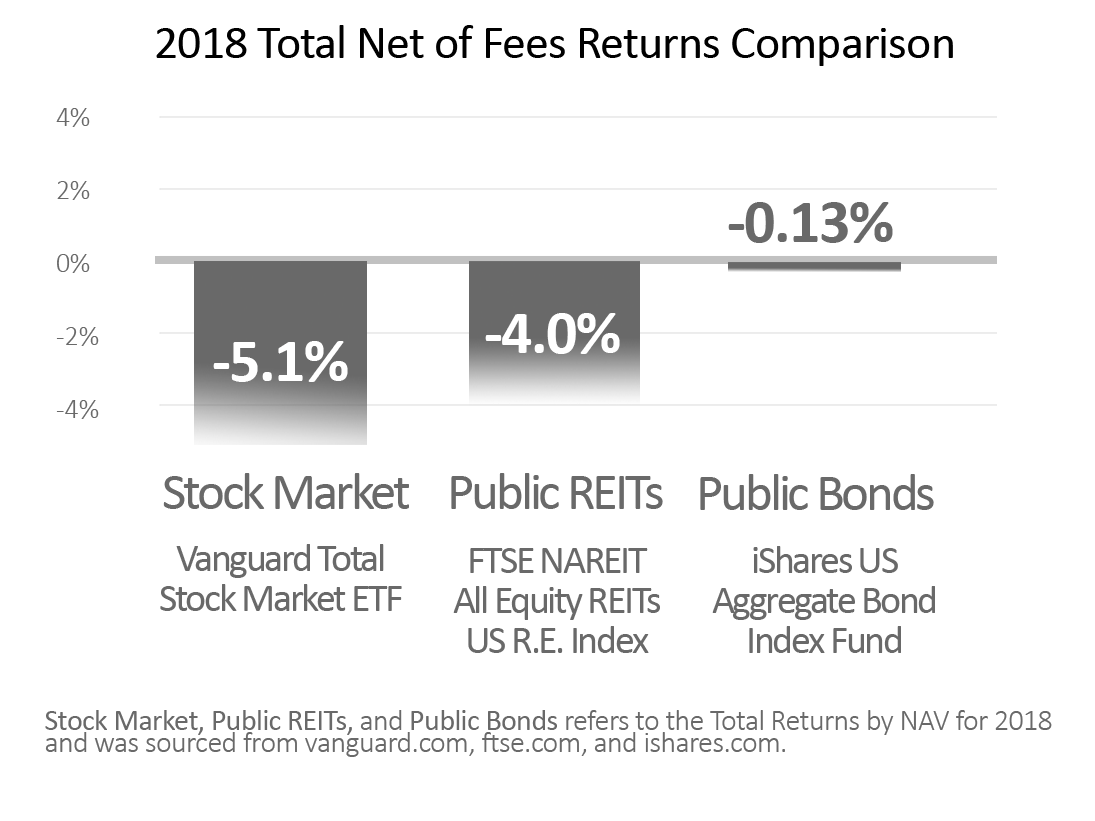

What a rollercoaster of a year for stocks, corporate credit, and almost any liquid security. The final box score for the year wasn’t pretty. The Vanguard S&P total return finished the year at -5.1%, the FTSE All-Equity REIT Total Return rounded home at -4%, and despite the year-end drop in rates, bonds didn’t do much to provide a return (-0.13%). In short, there was nowhere to hide.

Meanwhile, the fundamentals of the commercial real estate market remain quite healthy. Employment growth remains strong, the labor market continues to pick up remaining slack, office users are expanding, the development pipeline remains balanced, rents continue to move upwards. Trees will stop growing somewhere before they hit the sky, but that doesn’t mean the sky has to fall to meet the trees. As stewards of capital, our underwriting process remains steadfastly committed to focusing on negative shocks to tenants and properties, and as long as we can withstand such surprises, we believe the portfolio is on a path for long term success.

“A tree with strong roots laughs at storms”

– Malay Proverb

Streitwise shareholders should understand:

- We are but one component of an investor’s balanced portfolio

- We are oriented for the long-term

- We are not targeting capital appreciation through heavy value-add strategies, but rather a more consistent source of dividend income

- We are a direct owner and operator of commercial real estate

- We are not publicly traded on an exchange, meaning our REIT shares do not exhibit the express volatility of daily pricing

2019 – The Year Ahead

Our biggest focus in the new year will be acquiring new assets for the portfolio and implementing service upgrades on the shareholder interface front. With respect to new acquisitions, our goal is to double our portfolio value by the end of the year. We’re optimistic that the pipeline will allow us to add quality diversification to our shareholders’ existing portfolio. We continue to believe that there is a relative underpricing with respect to stabilized, non-coastal office properties, and intend to pursue that strategy further.

We have candidly not had much in the way of monthly or quarterly correspondence primarily because our portfolio is stabilized with no real updates beyond dividends! In the case of long term corporate tenants, no news is good news. That is the case with our portfolio. We are planning to make selective upgrades to certain buildings, lobbies and common areas, and are excited to share with you before and after photos as such renovations are completed. Our goal is to be in more regular communication so that our shareholders know that their assets are being properly managed, know that their tenants appropriately serviced, and are aware of any changes or shifts in the market landscape.

Technologically, it’s no secret that we are a real estate investment company first, and that we leverage third party vendors to provide the on-boarding and investor center services. As such, another primary objective is to work with our third parties to improve the service we provide our shareholders, from a simpler dividend reinvestment process for IRAs, Trusts and 401Ks to a faster on-boarding and registration timeline. Above all, our commitment to you is that we will respond to each and every shareholder issue or question in a timely manner and keep you updated along the way. What we cannot immediately offer in the way of a fancy, directly engineered software interface we will certainly offer in the way of direct human interaction. Believe it or not, some still prefer that method!

Here’s to a prosperous 2019. We hope to do well for, and right by, the Streitwise community.

Eliot Bencuya,

Co-Founder and CEO