Why Invest in a Streitwise REIT?

-

Professionally-managed real estate open to all investorsRare REIT offering open to non-accredited investors. See Properties in Offering section below.

-

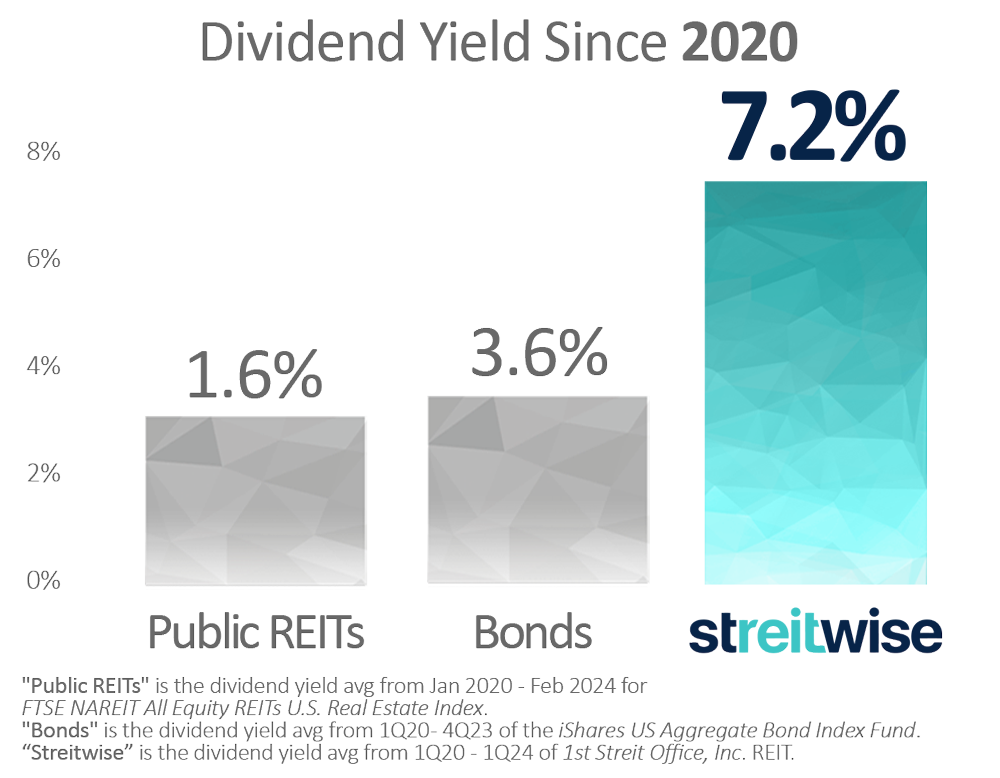

High dividend return history: 7.2% avg dividend1 since 2020Sponsor Tryperion Holdings has averaged 25.4% IRR / 2.0x on realized investments for fund investments since 2013.3

-

Hedge against inflationReal estate, such as REITs, are one of the best assets to hedge against inflation. REITs have outperformed the stock market over the last 30 years2

-

Over $20 million skin-in-the-game by founderShared alignment between investors and founder.

-

Highest-rated real estate investing platform by Motley FoolRated #1 by The Motley Fool out of 25+ investment platforms

-

Conservatively leveraged portfolio w/ long-term leases in place39% leveraged w/ an average weighted average lease term (WALT) of 4.84 years.

Open to

-

All Incomes: Accredited & non-accredited investorsYou don’t need to be a millionaire to invest in Streitwise.

-

Any location: USA & foreign investors

-

Account Types: Individual/joint, entity (SD IRA’s/401k’s, trust’s, LLC’s)